This report was written by:

Shagun Nayar – MAX Security’s Levant intelligence specialist

And reviewed by:

Darren Cohen – Senior Intelligence Manager of MENA & Oded Berkowitz – Deputy Chief Intelligence Officer

Executive Summary

From October 2019, a nationwide anti-government protest movement has emerged in Iraq, much of it directly and indirectly related to Iran, which led to former Prime Minister (PM) Adil Abdul-Mahdi’s resignation in November 2019.

Tehran’s influence on the political and security situation in Iraq has played a major factor in the instability witnessed over the past months. This is likely to continue to pose a challenge to the new PM Mustafa al-Kadhimi-led government over the coming months.

Additional challenges will be presented by Iraq’s deteriorating economy, which has been exacerbated by COVID-19-imposed restrictions on travel and business operations, as well as a decline in the demand for oil. Iran’s military and political entrenchment in Iraq is liable to deter US-aligned states and private enterprises from investing in the country over the long-term.

Given the US’s continued military presence in Iraq, Iranian-backed militias will likely continue their military campaign against US interests in the country over the coming months. While a large-scale armed conflict between the US and Iran in Iraq remains unlikely at the current juncture, the Iraqi government’s efforts to maintain cordial ties with both Washington and Tehran will pose a major challenge for the new government going forward.

Overall, the manner in which the newly formed government approaches Iran and its affiliated military and political groups over the coming months is likely to constitute a significant factor in the PM al-Kadhimi administration’s functioning and ability to implement reforms.

Travelers to Iraq are advised to regularly review their emergency and contingency procedures as a basic security precaution, as the ongoing tensions between Iran on one side and the US and its regional allies on the other will likely lead to additional hostilities. For on-ground or intelligence assistance contact us at: [email protected] or +44 20-3540-043.

Background & Current Situation

Political Situation

Following weeks of unruly protests, the Iraqi Prime Minister (PM) Adel Abdul Mahdi resigned on November 29, 2019.

On February 1, President Salih appointed Mohammed Tawfiq Allawi as PM-designate. Allawi resigned on March 1 due to his inability to gain sufficient political support to form a technocratic government.

Adnan al-Zurfi was appointed as the next PM-designate candidate on March 17. However, Zurfi’s candidacy was rejected by a majority of Iraqi Shiite parties, as well as several factions within the Iran-backed Popular Mobilization Units (PMU), who called him an “American Intelligence candidate”. Zurfi withdrew his candidacy on April 9.

On April 9, Iraqi President Barham Salih nominated the Iraqi National Intelligence Service (NIS) chief, Mustafa al-Kadhimi, as PM-designate. His candidacy was welcomed by nearly all Iraqi Shiite parties as well as Iran and the US. However, PMU’s strongly pro-Iran Kata’ib Hezbollah explicitly rejected his nomination as PM.

On May 6, 255 out of 329 lawmakers in the Iraqi Parliament approved al-Kadhimi’s government program, which vows to reduce public spending, fight corruption, and “listen to the demands of the protest movement.”

On February 22, 2019 Abdel Aziz al-Muhammadawi, a candidate strongly favored by Iran-backed Kata’ib Hezbollah, was appointed as the PMU Chief of Staff.

However, on the same day, four brigades, known as the Hawza militias, loyal to prominent Iraqi Shiite religious cleric, Ayatollah Sayyid Ali al-Sistani, issued a statement condemning al-Muhammadawi’s appointment. Sistani has publicly criticized Iran’s growing interference in Iraq’s affairs. On April 22, 2020 the Hawza militias split from the PMU.

Economic Situation

The US has extended sanction waivers to Iraq on Iranian energy imports a total of nine times since November 2018. Iranian natural gas imports reportedly account for approximately 40 percent of Iraq’s energy consumption. The latest such waiver was granted on May 6.

On April 20, Iraq reportedly announced that it had reduced Iranian energy imports by 75 percent due to near full sufficiency in domestic energy production.

However, on April 29, Iraq’s Minister of Electricity reportedly announced that replacing Iranian energy imports entirely cannot be realized immediately and that Iranian gas remains the “cheapest and easiest to transfer”. He further announced that the alternatives to replace Iranian oil are currently on hold due to domestic circumstances.

On April 12, the Organization of the Petroleum Exporting Countries (OPEC) Plus, of which Iraq is a member state, agreed to cut oil production by 9.7 million barrels per day (mbpd) to raise the global price of oil due to a fall in demand amid COVID-19 restrictions.

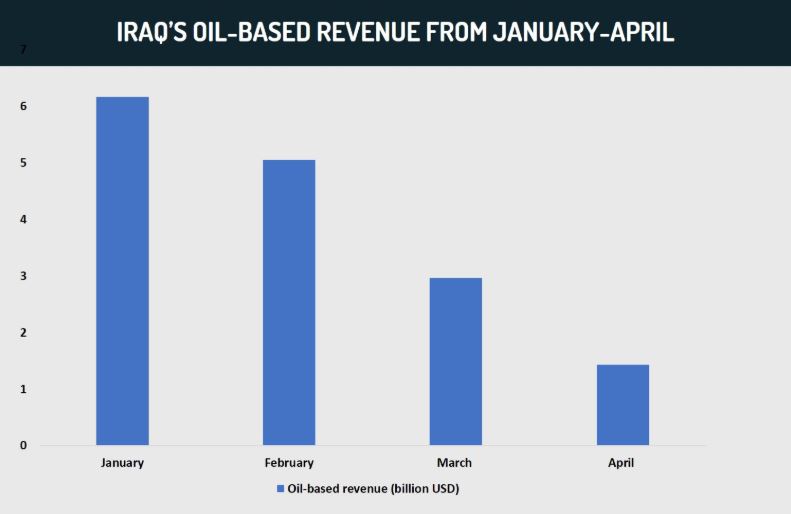

According to April 16 reports, Iraq shut down oil production at state-owned oil facilities in Basra. Even prior to the agreement, Iraq reduced its production by 100,00 barrels per day (bpd) from February to March. Iraq’s oil revenue reportedly fell by 28 percent in the first quarter of 2020. In April, Iraq’s oil revenue dropped to its lowest level in a decade, at 1.423 billion USD, with oil production averaging 3.854 mbpd.

At the current oil prices per barrel, Iraq’s budget deficit is projected at a negative 19 percent of the entire GDP by the end of 2020. Iraq’s projected real GDP growth rate for 2020 is negatively valued at approximately 4.7 percent, compared to a positive 3.9 percent in 2019.

The economy’s projected current account balance is negatively valued at approximately 21.7 percent, compared to a negative 1.2 percent in 2019.

US presence in Iraq

The US-led Coalition forces have partnered with Iraq’s security forces since 2014 to combat the threat of IS, which the Coalition states was “at the request of the Iraqi government”.

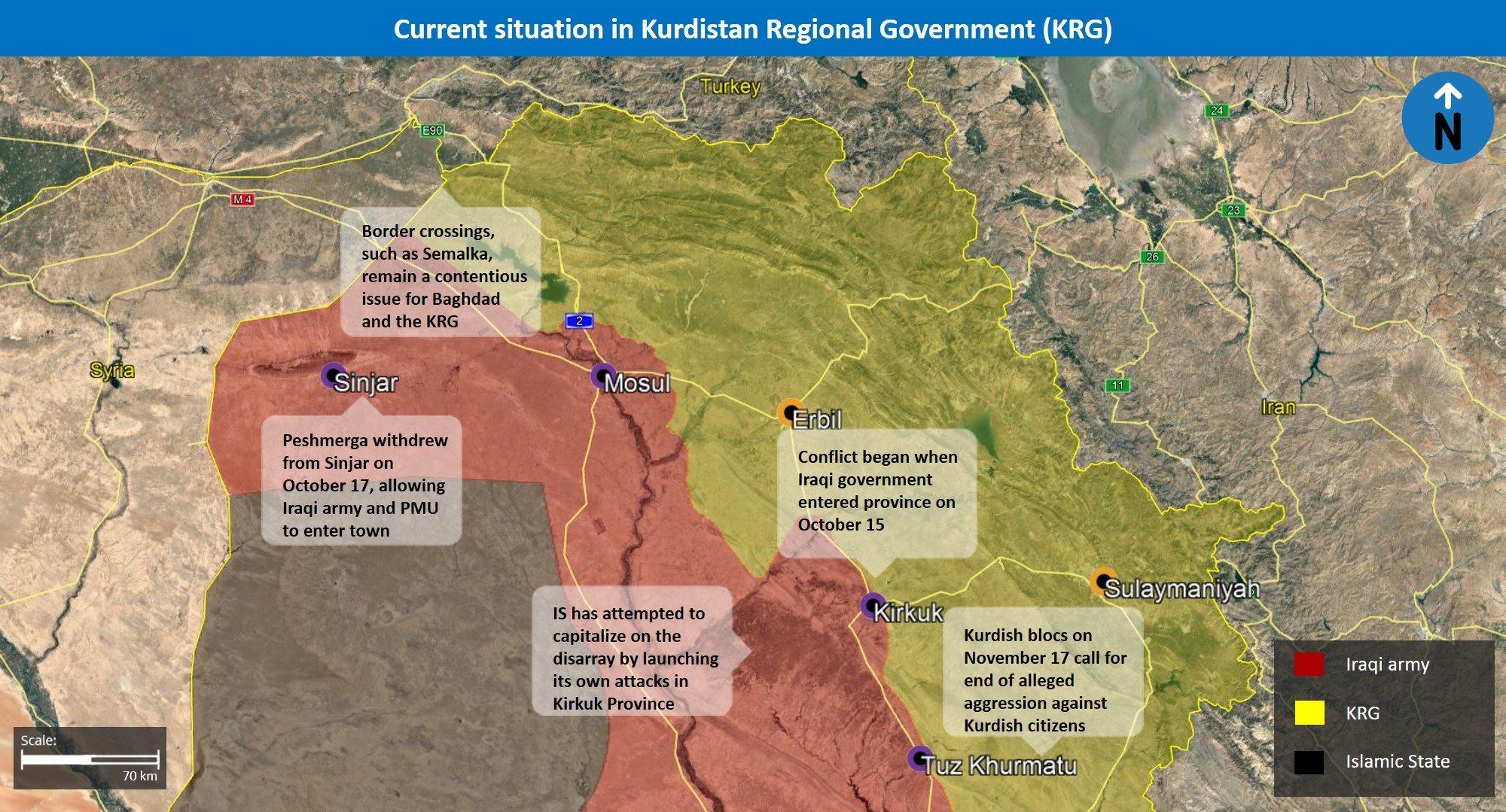

On December 27, 2019 a US civilian contractor was killed in a rocket attack targeting the K1 military base in Kirkuk. In retaliation, the US conducted airstrikes targeting several Kata’ib Hezbollah positions in Iraq on December 29.

On January 3, the US conducted airstrikes that killed the Islamic Revolutionary Guard Corps (IRGC)-Quds Force (QF) commander, Qassem Soleimani, and the Popular Mobilization Units (PMU) Deputy, and leader of the PMU’s Iran-backed Kata’ib Hezbollah, Abu Mehdi al-Muhandis, in Baghdad.

On January 5, with 170 Shiite votes, the Iraqi Parliament passed a non-binding resolution calling for the removal of all foreign troops from Iraq.

On January 8, Iran’s IRGC launched at least 22 ballistic missiles targeting the Ain al-Assad base in Anbar Province and US-linked targets in Erbil. Both locales are known to house US-led Coalition troops.

On January 10, the Spokesperson of the US State Department announced “we are committed to protecting Americans, Iraqis, and our coalition partners…any delegation sent to Iraq would be to not to discuss troop withdrawal, but our…force posture in the Middle East”.

Between March 17 and April 4, US-led “Operation Inherent Resolve” (OIR) Coalition troops, who support the Iraqi Security Forces (ISF), withdrew from several bases across Iraq.

The OIR Coalition announced its decision on April 16 to “maintain maximum pressure on the Islamic State (IS) despite…the COVID-19 pandemic”.

On April 6, three rockets landed near a facility operated by a US-based oil company in Basra’s Burjesia.

The joint civil-military Baghdad International Airport was targeted with rockets during the overnight hours of May 5-6. The facility is known to house US troops.

Civil Unrest

Between July and December 2018, anti-government protesters held persistent unruly demonstrations across Basra Province. Later, on October 1, 2019, an ongoing nationwide anti-government protest movement emerged.

Both movements mobilized around issues such as lack of employment and access to public services, as well as demanded an end to alleged endemic corruption.

They also denounced Iran’s alleged interference in Iraq’s domestic affairs, as evidenced by the torching of the Iranian consulate in Basra on September 7, 2018 and in Najaf and Karbala on November 27, 2019 and November 3, 2019, respectively.

Several protests were held in recent months to denounce the US military presence in Iraq, the most notable of which was the torching of the outer walls of the US Embassy by Iran-linked protesters on December 31, 2019.

As a result of the outbreak of the COVID-19 pandemic in Iraq and the ongoing nationwide curfew to mitigate its spread, the anti-government protest movement has remained largely suspended.

Following Kadhimi’s election as PM, on May 6 and 7, protesters marched in Baghdad to express their dissatisfaction with the newly formed government. A further protest was recorded in Baghdad on May 10 under the banner “the revolution has not ended”. On the same day, clashes between protesters and security forces were recorded in Basra city, and Nasiriyah Province.

Prior to this, on May 9, protesters burnt the headquarters of the Iranian-backed Badr and Al-Sadiqoun parties in Wasit Province. Al-Sadiqoun is the political wing of Asa’ib Ahl al-Haq (AAH).

On May 11, PM Kadhimi ordered the arrest of five Iran-linked “Thar Allah” militiamen for reportedly killing a protester and wounding several others in Basra city on May 10.

Assessment & Forecast

Entrenchment of pro-Iran elements in Iraq’s political, security spheres to prolong instability

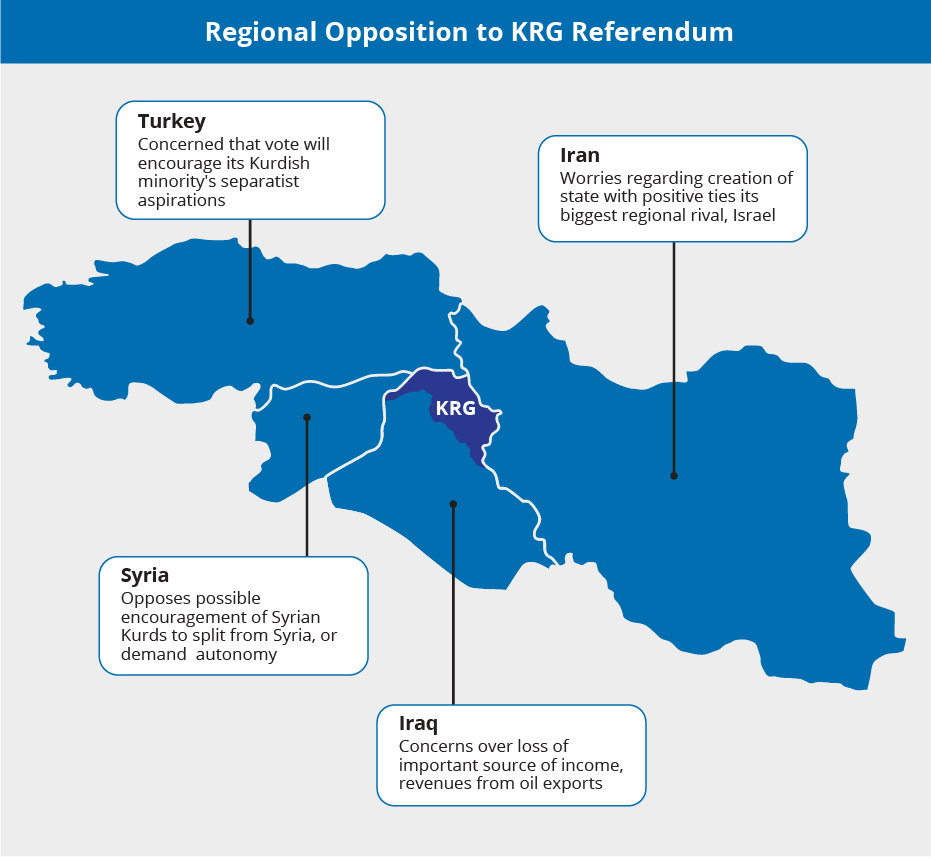

Iran, through a three-part strategy, has maintained significant influence in Iraq’s political process over the past years. First, it provided financial support and protection to Shiite parties in Iraq, particularly following Saddam Hussein’s ouster in 2003, thereby enabling such parties to enter Iraq’s political system. Second, it took advantage of the partial power vacuum to back several Iraqi Shiite militias, which gradually either joined or formed their own Shiite political parties. Third, it utilized IS’s targeting of Iraq’s Shiite population to project itself as the protector of Shiite interests in the country. In this context, it capitalized on the militant group’s resurgence in 2014 to establish a military presence in predominantly Sunni and Kurdish-held territories of northern Iraq, thereby expanding its influence pan Iraq.

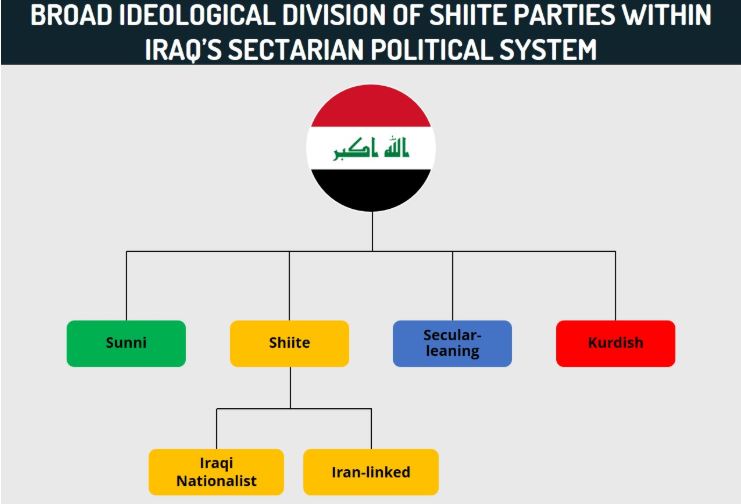

The political crisis that has materialized in Iraq since November 2019 can be partially attributed to the deeply ethnic and sectarian-based political quota system, also known as the “Muhassasa”, within which Iran exercises significant influence. Within the broad Shiite political bloc, this has also been characterized by discord within the PMU, which can be attributed to disagreements with respect to the PMU’s scope in Iraq. Pro-Iraq nationalist factions favor integration into the ISF, while pro-Iran factions favor autonomy from the ISF and the Iraqi PM, which allows these elements to conduct activities in accordance with Iranian policy, particularly the regional strategies of the Iranian Islamic Revolutionary Guard Corps (IRGC).

This has manifested in the reported formation of the “Islamic Front for Resistance”, made of explicitly pro-Iran armed factions, including Kata’ib Hezbollah, the Badr Organization, and Asaib Ahl al-Haq (AAH), which reportedly answer directly to the IRGC and have pledged allegiance to Tehran. It currently remains unknown whether the broader PMU leadership backs the front. Regardless, the reported formation of a more hardline alliance of Iran-backed Shiite militias either within or separate to the PMU highlights Tehran’s divisive role among Shiite political and military groups, who harbor significant power and influence in the political landscape and among the majority Shiite population.

While such internal discord has persisted since the PMU’s formation in 2014, the strong coordination between the IRGC’s Qassem Solemani and the PMU’s Muhandis prevented such issues from escalating. However, following the US-perpetrated killing of both leaders, such disagreements have reemerged, as evidenced by the defection of four pro-Iraqi nationalist Sistanti-led factions from the PMU on April 22, reportedly due to the February 22, 2019 appointment of Abdel Aziz al-Muhammadawi, known to be a strongly pro-Iran Kata’ib Hezbollah-backed candidate, as the PMU Chief of Staff.

This overall lack of cohesion partially contributed to the political vacuum in Iraq, characterized by the fact that the country functioned under a caretaker PM-led government from November 29, 2019 to May 6, 2020 due to the inability of two former PM-designate candidates to form a government amid a lack of support. This was chiefly due to a lack of political backing by Iraq’s Shiite coalitions, particularly the PMU’s political arm, the Fatah Alliance, which perceived such candidates as disadvantageous or indifferent to Iranian interests in Iraq. Overall, this highlights Iran’s direct and indirect role in prolonging political instability in Iraq due to its significant influence among prominent Shiite political and militia groups.

Iran’s influence within Iraqi political system to continue to present significant challenges for al-Kadhimi government

Given Iran’s long-standing position within Iraq’s political system, al-Kadhimi is unlikely to introduce major reforms that undermine the current status quo enjoyed by Tehran in Iraq. This is because such reforms would likely prompt the influential second-largest parliamentary bloc, the pro-Iran Fatah Alliance with 48 seats, and the pro-Iran “State of Law Coalition” with 25 seats, to pull support for the current administration. This, in turn, would likely trigger a political crisis that may lead to the potential dissolution of the al-Kadhimi-led government.

Thus, in order to avoid losing power and prevent a return to the political vacuum akin to that which was witnessed during the period between November 2019 and April 2020, al-Kadhimi will likely seek to broadly maintain the existing power structure. That said, the influence of Iran-backed militias may be slightly diminished due to the ongoing discord within the PMU. This is evidenced by the fact that the PMU overall supported al-Kadhimi’s candidacy despite Kata’ib Hezbollah’s explicit rejection. This indicates that some PMU factions, including those who are generally affiliated with Iran, are willing to apply pragmatism when necessary. This can likely be attributed to these elements’ fear that the complete disintegration and non-functioning of the political system may also pose a threat to Iran’s current influential role.

Meanwhile, al-Kadhimi has forged strong relations with officials from both Iran and the US in the capacity of his former position as NIS chief since 2016. It is very likely that in this position al-Kadhimi cooperated with both Iran and the US, the latter particularly in the context of the campaign against IS. FORECAST: The new PM will thus seek to leverage these ties that have been built up over recent years, which likely led to both Tehran’s and Washington’s broad approval of his candidacy, in order to strike the fragile balance between the parties’ competing interests.

FORECAST: However, Tehran’s influence within Iraq’s deeply sectarian and ethnic-based political quota system, and the competing claims of prominent Shiite factions in the government and policy-formation process, will continue to present challenges for the new al-Kadhimi-led government over the coming months. The administration will be compelled to satisfy multiple competing interests. In this specific context, alongside Iraq’s multitude of other security, political and economic challenges, the “Iran question” poses a specific set of dilemmas for al-Kadhimi. This includes the presence of the US-led Coalition on Iraqi soil following the January 5 parliamentary resolution to oust these forces, the level of political, military, and economic integration with Iran, and the ability of al-Kadhimi to rein in potentially rogue hardline Iran-backed elements within the PMU that refuse to comply with the Iraqi government’s orders.

Iranian attacks against US-linked interests, losses in oil revenue to exacerbate Iraqi economic situation

The periodic US-mandated sanction waiver extensions on Iranian energy imports have facilitated a largely uninterrupted supply of Iranian energy sources to fuel Iraq’s electricity needs. This is despite Washington’s global “maximum pressure campaign”, which has manifested in the form of economic sanctions on Iran and Iran-linked individuals and entities. These extensions are aimed at preventing a further deterioration of Iraq’s security environment, given that grievances over basic services, including electricity, have fueled violent anti-government demonstrations. Overall, and as evidenced by the US’s recent May 6 granting of a renewed 120-day waiver on electricity imports, these measures underscore Washington’s interest in stabilizing the country, even at the expense of making minor economic concessions to Iran. The particularly lengthy recent waiver, in comparison with prior waiver extensions, is indicative of the US’s effort to ensure a period of stabilization for the new government as short-term waivers can hinder the government’s ability to implement reforms against the background of energy uncertainty.

However, while the US government has demonstrated its willingness to actively prevent the collapse of the Iraqi economy, Iran-linked groups are likely to jeopardise the potential investment of US-based and US-affiliated private sector companies, which is vital for economic growth. The April 6 rocket attack targeting a US-based oil company facility in Basra and June 19, 2019 attack targeting the headquarters of major global oil companies in Basra illustrate the risks posed to US-linked facilities in Iraq, especially in the Shiite-majority areas of Basra Province where Iran is particularly influential. While no group claimed responsibility for either of these attacks, given that Iran-backed factions within the PMU have explicitly rejected the US’s presence in Iraq, and have conducted attacks against US interests in the past, their involvement remains highly likely. Although these incidents remain rare, they are likely to deter Western enterprises from investing or operating in Iraq over the coming months, particularly in the potentially lucrative oil sector. This is exacerbated by the fact that Iraq’s economic stability is largely contingent on the oil sector, which accounts for over 90 percent of its national budget and constitutes approximately 80 percent of Iraq’s total foreign exchange reserves.

Against this backdrop, there has been a significant drop in both oil production and oil prices, as evidenced by the 28 percent drop in oil-based export revenue in Q1 2020, and the decade-low oil revenue at 1.423 billion USD in April. Going forward, ensuring foreign investment in Iraq’s oil sector therefore remains paramount to the country’s economic prosperity. This is because while Iraq has significant oil reserves, a majority remain underdeveloped due to the lack of investment and technical expertise required to make such gas and oil reserves functional. Continued foreign investment in Iraq’s oil sector would therefore boost economic growth in Iraq, as well as making the country less dependent on Iran for energy imports, which remains a core US interest.

The ability of major foreign oil companies to operate in Iraq largely depends on the stabilization of Iraq’s security environment, which is currently undermined due to military actions by Iranian-backed militias, as well as IS. This has led to a decline in oil companies’ willingness to invest in the country’s oil sector, as evidenced by reports that only one Western company submitted an (unsuccessful) offer in Iraq’s April 2018 gas exploration auction. This event occurred after Iraq’s territorial defeat of IS in December 2017, which was anticipated to herald a new era of relatively increased stability in Iraq, and also predated the current period in which frequent attacks against US-linked interests occur. FORECAST: Thus, it remains even less likely that US and European-based oil companies will seek to invest in Iraq over the coming months, largely due to Iranian-backed militias’ and IS’s continued role in destabilizing the security environment of the country. This is further exacerbated by other considerations, including the currently diminished demands for oil, and added restrictions on travel and business operations both regionally and globally due to the COVID-19 pandemic. This is likely to further diminish Iraq’s domestic and foreign exchanges reserves, thereby further prolonging the economic crisis in the country.

FORECAST:The ongoing COVID-19 pandemic and resultant economic crisis are likely to have a short and medium term impact on Iraq’s gradual ability to reduce its dependence on Iranian energy sources. In this context, on April 20, Iraq reportedly announced that it had reduced Iranian energy imports by 75 percent due to near full sufficiency in domestic energy production. However, in light of Iraq’s Minister of Electricity’s statement that stated that “alternatives to replace Iranian oil are currently on hold due to domestic [COVID-19-related] circumstances”, Iran’s continued influence in Iraq’s energy sector will sustain over the coming months. Regardless, over the coming years, the reduction of Iraq’s energy dependence on Iran will create a vacuum in Iraq’s energy sector, which may facilitate a renewed role for Washington in exerting additional influence in Iraq.

US likely to retain military presence in Iraq despite rhetoric, military attacks by Iran-backed groups

The US troops’ training and financing of Iraq’s coalition of anti-IS forces, known as the ISF, which include the Counter-Terrorism Service (CTS), Iraqi federal police, the Iraqi Armed Forces, and the Iraqi border guard forces, have significantly contributed to mitigating the jihadist group’s threat in the country. This includes training Iraq’s security personnel in shooting, urban combat, and subterranean warfare techniques, undergoing courses. Furthermore, the US-backed ISF conducted 1,007 anti-IS operations between January and April, even amid a partial scale-down of such operations amid the COVID-19 pandemic.

However, despite this, the withdrawal of the US military has remained a long-standing goal of Shiite elements in Iraq. The January 3 assassination of Qassem Soleimani and Abu Muhandis drastically elevated existing anti-US sentiments in the country, including among segments of the non-Shiite populace. This is because the US’s military action in Iraq that killed two prominent military leaders without the prior approval of the Iraqi government, was perceived to be a violation of Iraq’s territorial integrity and national sovereignty. The assaasination of the IRGC-QF leader and Iran-backed PMU commander in Baghdad also resulted in a rare direct military confrontation between Iran and the US in Iraq, namely the IRGC’s January 8 ballistic missile attack targeting Anbar and Erbil provinces. This highlighted the potential for the US-Iran tensions to translate into armed conflict in Iraq, where the two states continue to fight over influence. Such incidents have prompted Iraqi nationalist-leaning groups and leaders to oppose Iraq becoming a battle ground between Washington and Iran and thus to oppose all foreign intervention in the state’s affairs. FORECAST: Iran is unlikely to engage in direct military confrontation with the US in Iraq in the foreseeable future and is likely to instead target US interests in Iraq through its backed militias. This is because it currently does not remain in the interest of Tehran to elevate hostilities with Washington given the latter’s imposition of economic sanctions against the former over the past years. Such sanctions have led to significant economic challenges in Iran, thereby decreasing the likelihood of Iran engaging in a full-blown armed conflict with the US in Iraq.

This also has an impact on the political arena. The US’s military presence has been consistently explicitly rejected by almost all Shiite parties and militias in Iraq over recent months, including those who prioritize Iraqi nationalism over a strong allegiance to Tehran. This is evidenced by the January 5 non-binding resolution wherein 170 Shiite votes called for the removal of “all foreign troops from Iraqi soil”. While it is notable that both Sunni and Kurdish parties boycotted the vote, illustrating the polarization in Iraq’s sectarian politics, the rare display of cohesion among the Shiite bloc demonstrated a notable consensus among these parties vis-a-vis the expulsion of US troops from Iraq. Meanwhile, in the ensuing period, on April 4, eight PMU factions published a statement “vowing” to “defend” Iraq against the US’s “occupation” and demanded that US troops depart from Iraq in line with the January 5 resolution. On March 16, a Shiite, likely Iranian-backed militia group “Usbat al-Thairen” claimed two attacks targeting the Basmaya and Taji camps and advised US troops to leave “vertically before we force them to leave horizontally”.

These developments illustrate the ongoing opposition among pro-Iran Shiite groups regarding Washington’s military presence in Iraq, albeit for differing motivations. The influential Shiite cleric Muqtada al-Sadr-led Sairoon Alliance opposes all foreign intervention in Iraqi domestic affairs for the aforementioned reasons, while the Iran-affiliated Fatah Alliance and Badr Organization seek closer ideological ties to Iran and the expulsion of US military forces. FORECAST: However, these developments were also a direct reaction to the US’s killing of Soleimani and direct US-Iran tensions inside Iraq have since slightly subsided and will likely continue to fade in the absence of new developments. Moreover, as illustrated by their boycott of the vote Kurdish and Sunni elements, as well as some Shiites, likely recognize the aforementioned role of the US in the anti-IS campaign and will be reluctant to allow the jihadist group to significantly reemerge.

FORECAST: Despite the persistent rocket attacks targeting US interests in Iraq, the existing anti-US sentiment among a considerable section of the Iraqi populace, as well as coronavirus-related health concerns regarding its military personnel in Iraq, the US remains unlikely to fully withdraw its troops from Iraq over the coming months. This is supported by the January 10 statement published by the US Department of State that stated “any delegation sent to Iraq would be to not to discuss troop withdrawal” as well as the April 16 decision by OIR that announced its decision to “maintain maximum pressure on IS despite…the COVID-19 pandemic”. Given this, Iranian-backed militias will continue their military action against US personnel and infrastructure in Iraq over the coming months, thereby prolonging the existing heightened tensions between Washington and Tehran in Iraq. This will lead to a further deteriorating of regional stability in the Middle East region.

FORECAST: The future of the US presence in Iraq will be based on a trade-off between political, economic and security considerations, and is slated to be discussed at the upcoming June “strategic dialogue” between Iraq and the US. While all Shiite parties and militias have continued to reject the US military presence, the new government will be compelled to strike a balance between Iraq’s multiple interests and ethnic groups. al-Kadhimi’s official position in his government program states that Iraq will promote the principle of “not allowing its territory to be used as a base for launching aggression against any of its neighbors and will not become a battlefield for regional and international conflicts”. This however has fallen short of advocating for the expulsion of the US forces’ presence in Iraq, which has reportedly triggered some pro-Iran groups to accuse al-Kadhimi of being too vague with respect to the issue. Given his recent rhetoric, while the new PM will likely seek to disentangle Iraq from becoming a battle ground between the US and Iran, he is unlikely to push for a broad withdrawal of US-led Coalition forces that would significantly harm Iraq’s anti-IS campaign. Al-Kadhimi will be cognizant of the US’s contribution from his experience as an intelligence chief. FORECAST: This assessment is bolstered by Iraq’s increasingly precarious economic situation. In order to maintain the aforementioned US-granted sanctions waivers over the coming months, the al-Kadhimi-led government will aim to balance political, security, and economic considerations in a way that does not run the risk of US-imposed economic sanctions against Baghdad which would harm the economy and thus aggravate existing severe socio-economic issues among Iraq’s anti-government protest movement.

Protesters to continue to mobilize around issue of Iranian involvement in Iraqi affairs, Iran-linked groups to employ violence at protests

A significant portion of unruly anti-government demonstrations has mobilized around the issue of Iran’s alleged interference in Iraq’s domestic affairs, as evidenced by the torching of the Iranian consulate in Najaf and Karbala on November 27 and November 3, 2019, respectively. Unidentified gunmen reportedly shot several unarmed protesters during the aforementioned demonstrations. While the details surrounding these shootings have not been officially disclosed, given the timing, location, and target, it remains likely that the shootings were conducted by members or supporters of Iranian-backed militias. Meanwhile on December 31,2019, PMU members and supporters torched the outer walls of the US Embassy in Baghdad, following the US-perpetrated December 29 airstrikes targeting Kata’ib Hezbollah positions in Iraq. Taken together, these incidents underscore Tehran’s destabilizing role in sustaining civil unrest in the country, either by indirectly encouraging anti-US protests, or due to the fact that the presence of Iran-linked institutions triggers demonstrations by anti-Iran locals, who are violently dispersed by Iran-backed forces.

FORECAST: The anti-government protest movement however will likely sustain over the coming months. This is because a portion of the populace perceives the new government to entrench what many protesters perceive to be an illegitimate sectarian-based, corrupt political system. This is evidenced by multiple protests in Baghdad denouncing al-Kadhimi’s newly formed government since it was sworn in on May 6, some of which were held under the banner “the revolution has not ended”. This is despite the new PM’s measures on May 9 to appease the protesters, such as the release of detained protesters and appointment of Lieutant General Abdul Wahab al-Saadi as commander of Iraq’s Counter-Terrorism Service (CTS).

In this context, the reinstatement of al-Saadi is particularly notable given that the nationwide protests that commenced in October 2019 were primarily triggered to denounce his ousting from the same role and provides some indication of the new al-Kadhimi-led government’s direction. Reports indicate that his demotion was motivated by Iranian considerations, as Tehran sought to gain influence with the CST, which is known to cooperate with the US, which reportedly founded and trained its forces. His return to the position may be indicative of a desire by the new PM to project his willingness to confront Iran-backed political interests, especially in the realm of security, given al-Saadi’s widespread popularity due to his role in the campaign against IS. Al-Kadhimi’s willingness to confront Iran-backed groups was also bolstered by his May 11 order to arrest five Iran-linked “Thar Allah” militiamen for killing and wounding protesters in Basra Province on May 10, which was very notable due to its rarity and illustrates he seeks to hold these groups to account. However, such decisions are likely to strain the new PM’s relationship with Iran-backed elements in Iraq that will undermine his legitimacy.

The mobilizing of protesters around the issue of Iran’s role in Iraqi affairs is likely to continue to be a focus of the anti-government protest movement. This is highlighted by the reported torching of the Iran-linked Badr Organization in Wasit Province on May 10. Such unruly demonstrations are part of broader anti-government protests and will add to the movement’s momentum in Baghdad and parts of southern Iraq. This, in turn, highlights how Iran-linked elements will present as an obstacle in the government’s efforts to introduce systemic reforms to address the protesters’ long-standing demands, either as a target of protest itself, or potentially, as a catalyst for additional unrest due to violence employed at demonstrations.

Moreover, as part of his government program, the new PM has pledged to establish a committee to investigate the violence at all protests since October 2019, which aims to compensate the families of those killed and individuals wounded in the demonstrations. However, many of those responsible were known to be Iran-backed militias and their supporters who al-Kadhimi relies on for support, which complicates the likelihood of an independent and thorough enquiry. This underscores Tehran’s significance in Iraq’s political and administrative apparatus. FORECAST: Given these political constraints, legal proceedings against such Iran-backed elements will unlikely comprehensively materialize, which may increase anti-government sentiment.

FORECAST: Overall, given Iran’s continued destabilizing role in Iraq’s political system, through its supported Shiite parties, the new al-Kadhimi-led government will likely avoid introducing any reforms that stand to systematically disrupt the current influence Iran enjoys. The broader challenges in enacting systematic government reforms, as well as the country’s deteriorating economic condition amid COVID-19 restrictions, will further exacerbate the populace’s existing anti-government sentiments, thereby prolonging civil unrest in the country. Such a scenario will be further compounded by the US’s refusal to completely withdraw its troops from Iraq over the coming months, potentially with the consent of the Iraqi government. This will both emolden Iranian-backed militias to conduct additional rocket attacks targeting US interests and increase the discord among the fragile Iraqi political landscape over those in favor and those against a US military presence in the country. All of these factors are liable to trigger unrest over the coming weeks and months.

Recommendations

It is advised to avoid all nonessential travel to Baghdad and Basra at this time due to the ongoing threat of militancy in these locales, violence in areas surrounding the cities, and the risk of a broad deterioration of security conditions.

For those conducting essential operations in Baghdad, it is advised to restrict travel to the Green Zone and ensure that contingency and emergency evacuation plans are updated. Contact us for itinerary and contingency support options.

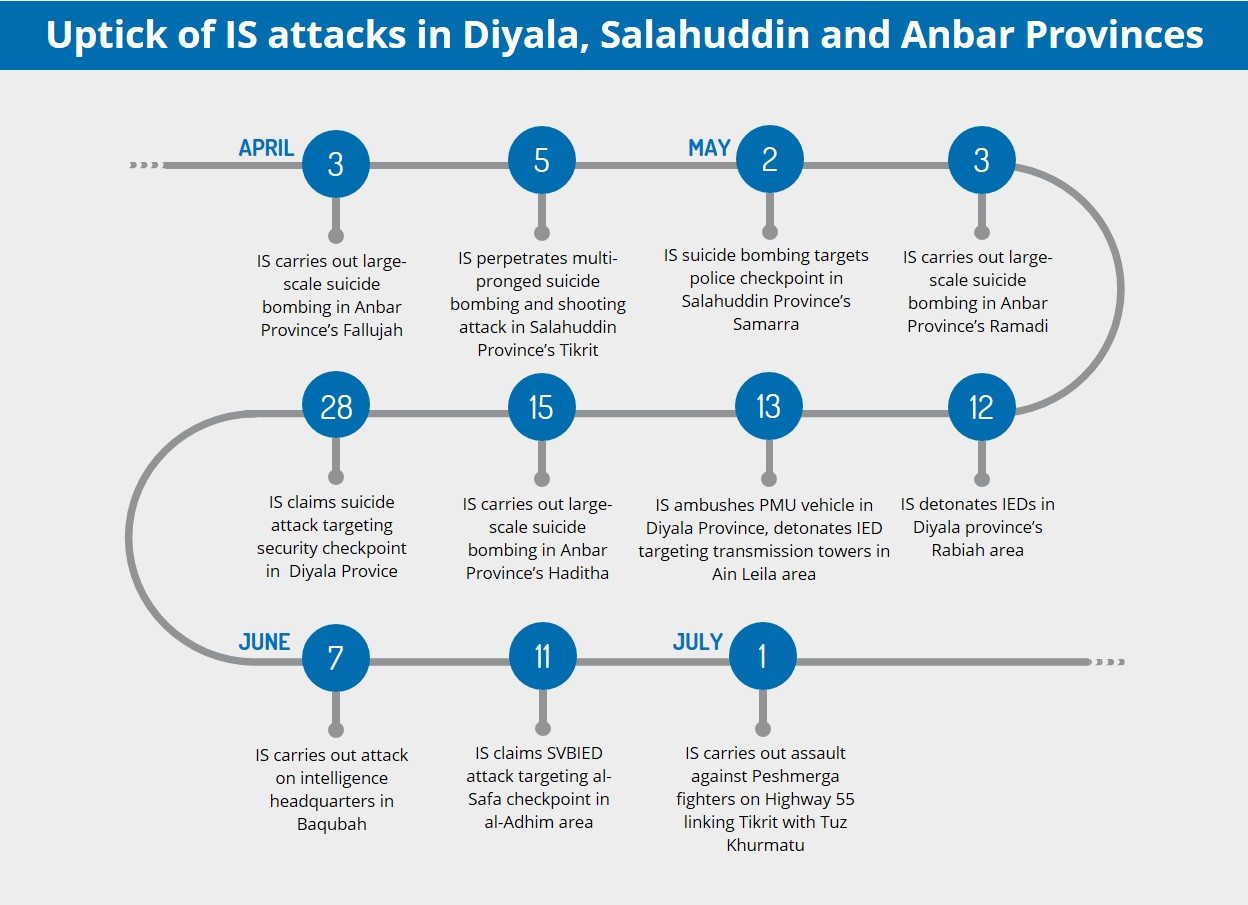

Travel to Anbar, Nineveh, Salahuddin, Kirkuk, and Diyala Provinces should be avoided at this time due to ongoing counter-militancy operations and militant attacks. Those operating in these regions are advised to contact us for itinerary and contingency support measures, including evacuation options, given the deterioration in the security situation.

Those operating natural gas or oil facilities are advised to obtain security consultation for facilities in outlying areas, specific to the nationalities and operational needs of their employees.

As a general precaution, it is advised that any travel, particularly in outlying areas, be conducted in armored vehicles, with proper security escorts and coordination with authorities.

Foreigners, particularly Westerners, continuing to operate in Iraq are additionally advised to maintain a low profile, exercise heightened vigilance, and avoid locales frequented by foreign, particularly Western nationals. To mitigate the risk of attacks or abductions, ensure that places of stay are equipped with sufficient perimeter security details, alter travel routes, and avoid disclosing sensitive itinerary information to unknown individuals. As a general security precaution, avoid revealing to strangers your position or affiliation with foreign-based firms, as your response could attract a negative reaction from locals.