MAX Intelligence: Trump’s Middle East Policy: Sanctions, Arms Deals & Israel Ties

- MAX Security

Table of Contents

A deep dive into what a second Trump presidency means for Iran, Gulf relations, Israel, and US power in MENA.

Executive Summary

-

Washington’s policy vis-a-vis Tehran will manifest in the return of the “maximum pressure” campaign. This will entail stricter economic sanctions targeting Iran’s oil exports, shadow networks, and facilitating countries and proxies.

-

A transactional framework will likely guide President Donald Trump’s approach to Gulf states, prioritizing arms sales, economic partnerships, and collective regional defense to counter Iran and curb Chinese and Russian influence, as well as facilitate normalization agreements with Israel.

-

Turkey’s NATO membership and increasing power projection and regional influence will enable it to remain a strategic ally for Washington. However, this is also liable to engender feuds rooted in diverging geopolitical and ideological stances, especially with regards to Israel and Syria, and Ankara’s support for Islamist factions regionally.

Introduction

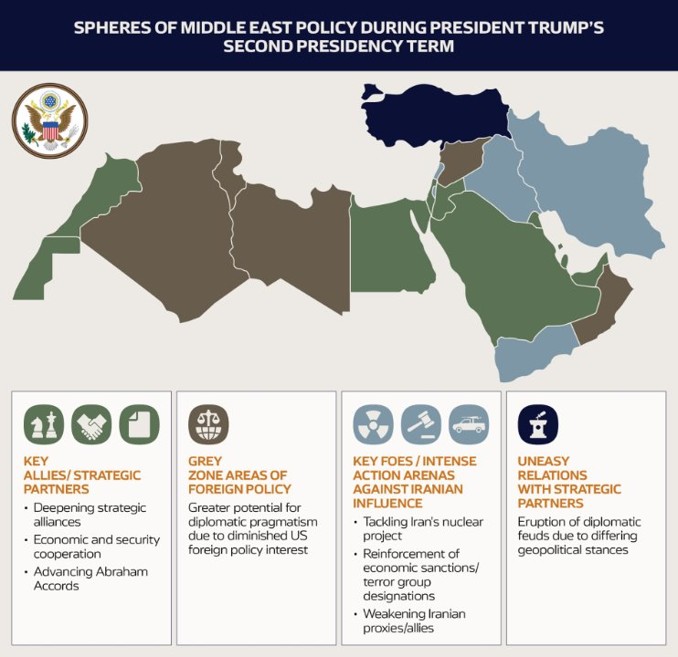

Donald Trump’s re-election in 2024, coupled with Republicans securing a trifecta, provides him with a broad mandate to shape US foreign policy in the Middle East and North Africa. Trump’s first presidency between 2017-2021 was defined by unconventional, transactional, and partisan approaches to diplomacy that disrupted, to some extent, traditional US policy norms, such as adherence to formal UN stances on global issues. His landmark policies, including the withdrawal from the Iran nuclear deal (JCPOA) and the push to secure the Abraham Accords, further emphasized his resolve to obtain swift and tangible results. In contrast, former President Joe Biden administration’s value-driven, multilateral approach to the region faced some hurdles and received backlash. This was most significantly highlighted in much colder relationship between his administration and Saudi Arabia. President Trump is expected to frame his predecessor’s legacy as reversals of the perceived progress achieved under his first term, focusing on renewed efforts to reassert US dominance in the MENA region. The second Trump administration is anticipated to remain anchored in the policies of his first term, combining a strongly pro-Israel stance, a hardline approach to Iran, and a commitment to advancing diplomatic breakthroughs with allies through a transactional approach.

Overview

President Trump’s Middle East policy to be more hardline toward Iran

Iran will likely constitute the central focus of President-elect Donald Trump’s Middle East policy during his second term, with his administration likely to uphold a hardline strategy. It will be aimed at crippling Iran’s economy to stifle its nuclear ambitions and its funding of proxy groups, which are perceived as a direct threat to US interests and those of its allies. This approach is expected to build upon the “maximum pressure” policy from his first term, which aimed to undermine Tehran’s economic stability through the imposition of stringent sanctions. The strategy sought to compel Iran to renegotiate its nuclear program and diminish its regional influence, although this has not led Iran to cave in. Iran has reportedly engaged in attempts to assassinate Trump on US soil and also been accused of efforts to interfere in his electoral campaign over the past year. These are likely to further cement Washington’s confrontational posture.

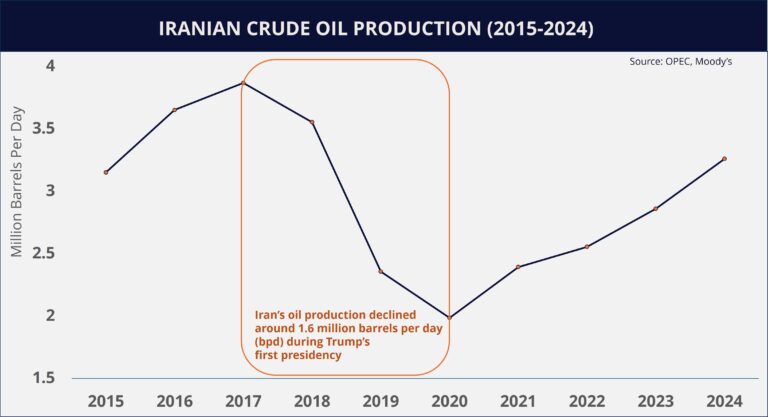

President Trump will likely impose stricter sanctions on Iran’s key revenue sources, particularly oil exports, which reportedly dropped from 3.8 million barrels per day (mbd) in 2018 to under two mbd by 2020. Production resurged under former President Biden to 3.2 mbd, partly due to an increase in imports by China, which stands as Tehran’s biggest buyer, consuming around 90 percent of Iranian oil exports. Iran’s ability to evade sanctions has significantly increased in recent years, relying on shadow networks and front organizations that support its “dark fleet”, allowing it to bypass restrictions and expand oil sales. With Trump’s return to office, China’s trade with Iran may be disrupted by reimposed US sanctions and a more robust direct punitive action against the trade. At the same time, the administration will likely seek to identify loopholes to tighten sanctions enforcement. President Trump may also broaden penalties to include sectors such as Iran’s technology and financial networks, as Iran reportedly increases tech and military exports to Russia. Additionally, secondary sanctions targeting international companies and individuals, such as those in Turkey, the UAE, Russia, and China, that help Iran circumvent sanctions are expected to intensify.

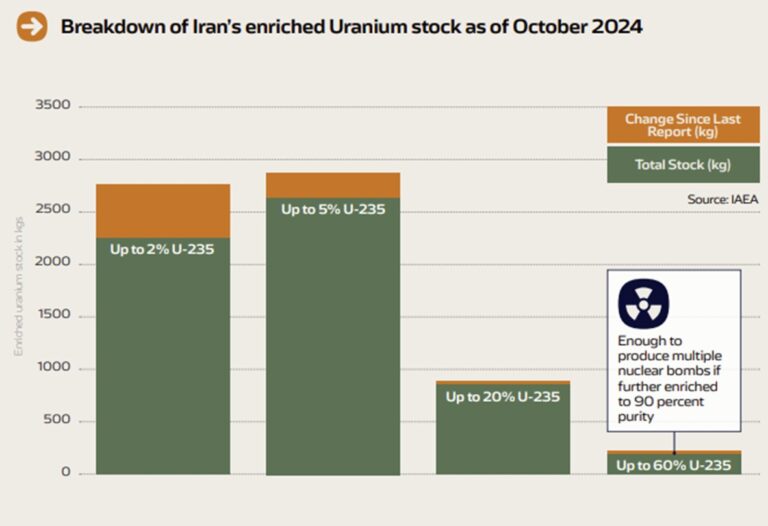

Iran’s recent nuclear advancements are expected to be a central focus of the Trump administration. A December 2024 IAEA report reveals a significant rise in uranium production at the Fordow enrichment facility, with monthly production of 60 percent enriched Uranium increasing from 4.7 kg to 34 kg. Tehran currently possesses around 200 kg of 60 percent enriched uranium, enough to produce multiple nuclear bombs if that stock is further enriched to 90 percent, a weapons-grade level. This, in turn, is a technicality that could be achieved within a very short time span.

President Trump is also likely to push European allies to trigger the “snapback” mechanism under the 2015 UN resolutions. This mechanism allows for the reimposition of extensive Western sanctions on Iran, which is set to expire in October 2025. Consequently, Trump may adopt unilateral measures to enforce compliance, potentially including the military option of an airstrike campaign against Iran, a strategy already voiced by senior officials of his administration. This hardline stance could garner bipartisan support, as the Democratic Party also considered a military response under Biden.

Nevertheless, in the immediate term, the president is more likely to capitalize upon the tilting of the regional geopolitical landscape to the detriment of Iran and Iran’s current vulnerability to bring Iran back to the negotiation table by utilizing a transactional approach. To solidify his leverage, he will likely raise the military option as a viable one and provide advanced weapons, such as bunker-buster munitions, to improve Israel’s ability to carry out the operation itself. While this may deter Iran and facilitate negotiations in the short term, the mistrust between the new US administration and Tehran will be significant. Washington’s regional allies will be lobbying for a firm stance on Iran, including militarily, so that the strategic window of opportunity to derail Iran’s nuclear project is capitalized upon.

The US’s hardline approach will also likely be visible in countries where prominent Iran-backed factions operate, including Lebanon, Yemen, and Iraq. In these arenas Washington will utilize a “carrots and sticks” approach to diminish Iran’s influence and weaken Tehran’s allies. This was already highlighted in President Trump’s redesignation of the Houthis in Yemen as a Foreign Terrorist Organization (FTO). This policy stance will also constitute a pressure mechanism against the governments in these states to exclude Iranian allies from decision-making capacities and diminish their influence. For example, this is currently manifesting in Lebanon’s government formation process, in which Washington is reportedly heavily involved in pressure against the inclusion of Hezbollah in key portfolios. Nevertheless, the use of proxies and regional allies will continue to be a prominent feature of Iran’s foreign policy. Tehran retains extensive influence over some of them based on these actors’ ideological adherence to Iran and/or the extensive material support it provides them. In turn, Iran uses these actors to gain leverage in times of tension while retaining plausible deniability. Therefore, tensions between Iran and its allies, on the one side, and the US and its allies, on the other, will continue to persist. These along with regional tensions may be characterized by periodic eruptions of cross-border attacks against Iran’s regional foes. Iraq and Yemen will constitute the major launchpads for these attacks and periods of regional hostilities. This is because of the entrenchment of Iran-backed Shiite militias in Iraq and the Houthi movement in Yemen, both of which possess long-range Iranian missiles and drones that can be used against Iran’s foes.

President Trump’s policies to be transactional vis-a-vis Gulf allies

President Trump’s policy toward the Gulf states will likely be transactional in nature, with a continued emphasis on strengthening US-Gulf relations in areas like the economy, defence, and security. This will mostly be comprised of Trump’s relative disregard of values-oriented approach, such as considering governments’ human rights records, which strained relations between Washington and several of its strategic Gulf allies under former President Biden, particularly Saudi Arabia. An example of President Trump’s transactional approach was underscored in his first phone call with a foreign leader as President on January 23, which was with the Saudi Crown Prince Mohammed bin Salman (MbS). During the conversation, MbS pledged to invest 600 billion USD in the US over the next four years, prompting the President to consider untraditionally visiting Saudi for his first foreign trip in office.

President Trump will likely try to utilize this transactional approach, and a resultant greater level of trust between him and the Crown Prince, to push to expand cooperation between the parties. One focus area for will be on influencing OPEC+ decisions to prevent high oil prices from straining the global economy and US consumers. Expanding the Abraham Accords to include Saudi Arabia will likely be another key emphasis within this project, with incentives such as defense-related agreements and nuclear power generation potentially growing to be more lucrative during his term. The Palestinian issue will continue to be the most significant hurdle in that process vis-a-vis Saudi Arabia. Despite a hardline approach toward Palestinian factions, including the Palestinian Authority (PA), the above-mentioned issues could prompt the Trump administration to also offer some concessions to the PA, such as economic initiatives and/or pressurizing Israel to engage in some form of non-binding talks with the PA. The administration will also likely seek to include other Gulf states in the accords, such as Qatar and Oman. This endeavor is less likely to succeed in the short-to-medium term, amid elevated tensions between Israelis and Palestinians. Oman would risk losing its standing as a neutral mediator in regional conflicts, and Qatar is highly likely to resist thaw with Israel against the backdrop of its support to Hamas and broader ideological alignment with Turkey as the leader of another regional bloc that is increasingly hostile to Israel.

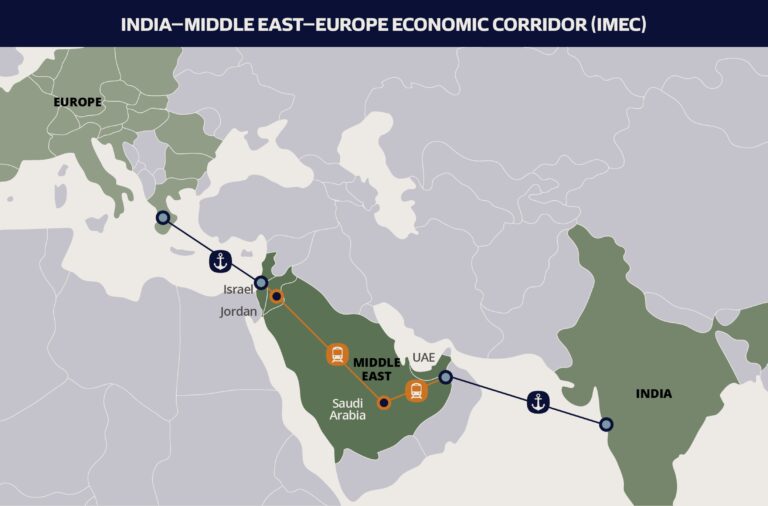

Regardless, the Trump administration will continue providing strong security guarantees and support for Riyadh’s defense and economic programs and advance regional cooperation schemes that involve the US’s Gulf allies and Israel. Another dimension of increased focus in this regard will likely be attempts to reinvigorate the previous administration’s India–Middle East–Europe Economic Corridor (IMEC) plan to connect infrastructures between the UAE, Saudi Arabia, Jordan, and Israel to increase accessibility between global East and West. Such grand infrastructural projects would also be in the Gulf countries’ interests as part of their vested interest in diversifying their economies away from oil, as well as diminishing their dependence on maritime trade through the Arabian/Persian Gulf.

The Trump administration will continue to push for large-scale arms sales with Gulf allies, framing them as vital for regional security and for the US economy alike. Trump will prioritize securing tangible benefits for the US, such as large-scale defense contracts, energy cooperation, and investments in American infrastructure and industries. In doing so, Trump will seek to counter attempts by Russia and China to make inroads in the realm of economic and diplomatic influence. This will be manifested in the US’s efforts to supplant grand cooperation schemes, such as major infrastructural projects or defense-related partnerships. Part of this effort would include alleviating Washington’s tendency to tie economic support and partnerships to countries’ adherence to international values, which has partially eroded US influence and somewhat alienated Washington in the face of other global powers that did not do so. This, in turn, would increase the US’ competitiveness with its global foes.

Trump administration to promote pro-Israel policies while pushing regional agreements, transactional engagement with PA

The Trump administration’s overt commitment to support Israel will mirror the policies of his previous term. Landmark decisions such as the 2018 relocation of the US Embassy to Jerusalem and the 2019 recognition of Israeli sovereignty over the Golan Heights set a precedent for such unilateral moves. Key appointments, such as Marco Rubio as Secretary of State and evangelical Mike Huckabee as Ambassador to Israel, further reflect the administration’s expected strong support for Israel, which is also partially enshrined in ideological alignment with Israel’s Religious Nationalist factions. For example, Huckabee has long rejected the idea that a Palestinian state should be established in the West Bank. This positioning was also demonstrated by Trump’s lifting of all previously imposed sanctions on Israeli extremists involved in violence against Palestinians. This, in turn, may lead to expanded Israeli construction in the West Bank, primarily the E1 settlement project between Jerusalem and Ma’ale Adumim, which the previous administrations opposed based on the Palestinian perception that it would bisect the West Bank into two parts. Taken as a whole, this will bolster anti-Israel and anti-US sentiment among the Palestinians, increasing prospects for militancy and unrest.

The Trump administration’s diplomatic strategy will seek to provide robust diplomatic cover for Israel on the international stage following years which have recorded Israel’s international standing being eroded in the face of international criticism. The US’s umbrella will include preventing tangible repercussions for Israel at the UN. Meanwhile, the recent passage of the “Illegitimate Court Counteraction Act,” which seeks to sanction the International Criminal Court (ICC) for “illegitimate and baseless actions” targeting the US as well as the arrest warrants against Israeli PM Benjamin Netanyahu and former Defense Minister Yoav Gallant. This highlights the Republicans’ intent to provide an expansive legal shield for Jerusalem. An erosion in the US’s support to Palestinian factions, including the Palestinian Authority (PA), would also be characterized by cutting off aid provision. This was already implemented in the defunding of the UN Relief and Works Agency (UNRWA), which relied on Washington for around 38 percent of its budget, triggering a pursuit of new donors.

With that being said, President Trump’s achievement-oriented approach and pragmatic disposition could also prompt renewed engagement with the PA; while using the hardline stances he implemented as a new set of “carrots and sticks.” Despite probable objections within his administration, he may attempt to use this leverage to try to revive a peace initiative between Israel and the PA, particularly as he seeks high-profile diplomatic achievements. This could translate into extensive pressure on Israel as well, especially given Saudi Arabia’s and other states’ alignment with a notion that normalization processes with Israel would need to entail at least a process that signal the workings toward the establishment of a Palestinian State. Such pressure would likely trigger extensive political division within both Israel and the West Bank, with animosity between the parties remaining extensive in the coming years.

Strategic alliance with Turkey to encounter challenges due to differing ideological, geopolitical stances

The Trump administration’s approach to Turkey in its second term will likely continue to be underpinned by Ankara’s status as a NATO member and strategic partner, with its geographic positioning between Europe, the Middle East, and the Caucasus guaranteeing that the US remains reliant on its cooperation. However, President Recep Tayyip Erdogan’s increasingly independent foreign policy, ideological leanings toward a stream of political Islam that opposes the US and the West, and regional ambitions will likely present significant points of friction between the two countries. This is especially in light of Ankara’s bolstered regional standing and interventionism which contributed to the toppling of Bashar al-Assad’s rule in Syria and will likely lead Turkey to become the most impactful regional actor in Syria.

Turkey has been operating for years beyond its territory in MENA and other regions to expand its influence. Nevertheless, Syria’s regime change constitutes the first time in which Ankara’s direct intervention and cultivation of proxies culminated in the toppling of a hostile government and the establishment of a government that shares Ankara’s Sunni Islamist inclinations. This bolsters Turkey’s regional and international identity under President Erdogan as a leader in the Muslim world and a prominent actor that further exerts influence, making it the most dominant actor in Syria together with Qatar, Turkey’s close ally. Despite President Trump’s relative lack of interest in Syria, Turkey’s increased influence in Syria will conflict with US interests, particularly given Washington’s continued support for the Kurdish-dominant Syrian Democratic Forces (SDF). The latter is viewed by Ankara as an extension of the People’s Defense Units (YPG)/Kurdistan Workers’ Party (PKK), which it designates as terrorist organizations, and Ankara would work to see the SDF and the Kurdish-dominated autonomy it holds in Syria, dissolved. Such a development would inherently diminish Washington’s influence in Syria.

President Erdogan may wish to capitalize upon the US President’s apparent indifference regarding Syria, which conversely also allowed him to launch a major campaign against Syria’s Kurds during President Trump’s first term. Nevertheless, it is liable to lead to friction between the parties, along with other issues that would unearth ideological differences between the sides. This includes Turkey’s support of Hamas and its increasing animosity vis-a-vis Israel.

Another area for possible friction between Turkey and the US would be over schemes like the abovementioned IMEC. This is because Turkey’s increased influence in Syria and its ability to support the stabilization of the new Hay’at Tahrir al-Sham (HTS)-led government would also likely result in Ankara’s and Doha’s large-scale investment in grand infrastructural projects in Syria that will be aimed at making Turkey, through Syria, the land bridge to connect between the Gulf and Europe (and by extension between the global East and West). This will be posed as a competition to Washington’s and Jerusalem’s desire to see Israel become that land bridge, as per the IMEC stipulations.

North African countries, including Libya, unlikely to be prioritized in US foreign policy under Trump administration

Libya has been an area of interest for the US partially in light of Russia’s extensive involvement in it with its backing of Khalifa Haftar and the Libyan National Army (LNA), which controls the eastern parts of the state. In that sense, from a strategic standpoint, Libya has traditionally been treated as a crucial component of NATO’s southern flank. Nevertheless, during his first tenure, President Trump had signaled a degree of support for Haftar and the LNA by recognizing their important role in the country’s politics. This highlighted President Trump’s inclination to recognize and work with strongmen, such as Haftar, which will likely broadly continue under his second term. At the same time, Haftar’s potential role in facilitating an expanding Russian presence in eastern Libya to compensate for Russia’s apparent loss of its strategic Mediterranean assets following the collapse of the Bashar al-Assad government in Syria (Hmeimim Airbase and Tartus Port), may prompt more significant pressure on the LNA by the US administration.

Nevertheless, in a situation where the Libyan civil war is still dormant with efforts to reconcile the country’s parallel governments stalled, it is unlikely that Libya will resurface to become a priority in the US’s Middle East policy under President Trump’s second term. This will potentially provide leeway for Russia, as well as Turkey, who are directly and more heavily involved in Libya, to expand their footprint and influence in eastern and western Libya, respectively. This relative lack of US interest will also likely manifest in other North African countries, with Algerian continuing to traditionally lean toward strong cooperation with Russia, and Morocco aligning more strongly with the US, given the improved strategic partnership between the parties since the Abraham Accords.

President Trump likely to maintain transactional, pragmatic relations with Cairo, Rabat based on shared interests

President Donald Trump’s prior administration demonstrated strong support for Egyptian President Abdel Fattah al-Sisi, with both leaders sharing personal camaraderie. During Trump’s tenure, US-Egypt ties focused heavily on bilateral security cooperation and trade. As in the case of Saudi Arabia, Egypt is expected to benefit from Trump’s return to the White House in the sense that the latter will be inclined to disengage from a values-driven approach, which constituted a hurdle during Biden’s administration. This will lead to a much more transactional relationship through revived economic incentives and reduced scrutiny of human rights.

In this context, Cairo will likely seek to secure economic packages and arms deals vis-a-vis Washington, which are currently crucial for Egypt amid its economic hardships. Washington will extend extensive support to Cairo as long as it continues to function as a crucial strategic ally that is aligned with what the US perceives as the “moderate” camp in the Middle East that entails Saudi Arabia, the UAE, and Jordan. An emphasis for the Trump administration in this regard will also be aimed at countering Russian attempts to increase its strategic relationship and influence in Egypt and wider North Africa. This manifested in recent years in growing bilateral relations between Cairo and Moscow, which partly manifested in strategic national projects, such as Egypt’s first nuclear power plant at El-Dabaa that is built by Russia’s state atomic energy corporation (Rosatom).

Meanwhile, Morocco is expected to retain robust ties with the US under a second Trump administration, leveraging its long-standing alliance and strategic position in North Africa, as well as its historic role that advanced Trump’s Middle East policy in his first term. This pertains to the Trump administration’s 2020 recognition of Moroccan sovereignty over Western Sahara, secured in exchange for Rabat’s normalization of relations with Israel, which was a pivotal diplomatic success for Morocco. While the Western Sahara issue holds limited relevance for US strategic interests, Morocco’s alignment with US priorities. This is evidenced by Morocco’s ongoing relationship with Israel despite domestic protests since the eruption of the October 7, 2023, Israel-Hamas war reinforces its role as a key regional partner of the US. This also reiterates President Trump’s transactional approach rather than a values-based approach, in the sense that his policy vis-a-vis Morocco broke a decades-long US policy of aligning with the UN’s advocacy of a referendum in Western Sahara to determine the region’s fate.

Summary & Outlook

President Trump’s administration will likely seek to give continuity to its policy stances from his previous administration, which it perceives as successes in Washington’s foreign policy, capitalizing on a Republican trifecta which will likely facilitate smoother policymaking. The legacy President Trump will seek to revive is a robust support to the US’s major Middle Eastern ally, Israel, as well as a more productive and transactional relationship with its other regional allies, especially Saudi Arabia. Its emphasis will be facilitating a more robust security and economic relations with the latter, and an extensive effort to conclude a deal to establish normalization between Israel and Saudi. Meanwhile, President Trump will reinstate its “maximum pressure” campaign against Tehran and its regional allies, seeking to further diminish Iran’s influence in multiple arenas in MENA, as well as pressure it to forsake its nuclear project.

SCOUT

INTEL AI BY MAX SECURITY

Fill in your details to schedule a demo with our team.