Executive Summary

While the main conflict in Yemen is ongoing between the Houthis and members of the Saudi-led Coalition, Sunni jihadist groups have been able to take advantage of the existing relative vacuum in power to entrench themselves in the southern part of the country.

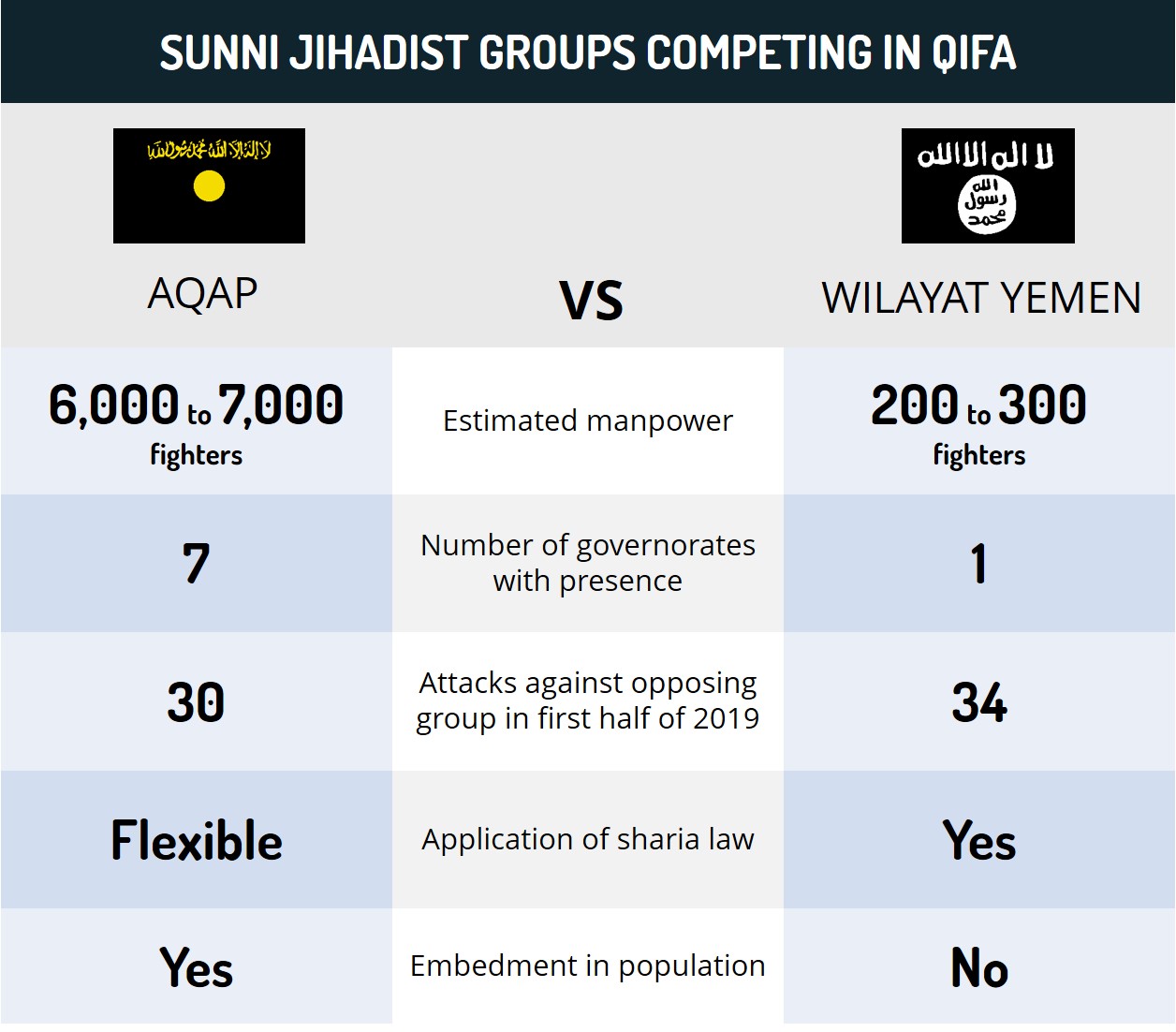

These groups, namely al-Qaeda in the Arabian Peninsula (AQAP) and the local Islamic State (IS) affiliate Wilayat Yemen, have developed a growing competition between each other for recruits, areas of control, and influence in Bayda Governorate’s Qifa area, with the frequency and sophistication of attacks conducted by both groups peeking at the end of March.

Both groups, particularly AQAP, seemingly bolstered their online propaganda and recruitment efforts as well as attempts to delegitimize one another in the eyes of locals during this period.

Given AQAP’s overall better ties with the local population, such propaganda efforts will likely prove a more effective tool for the group to further expand their local backing.

We advise to avoid all travel to Yemen due to the limited government and security presence, ongoing clashes and airstrikes as well as the heightened threat of attacks and kidnappings.

Current Situation

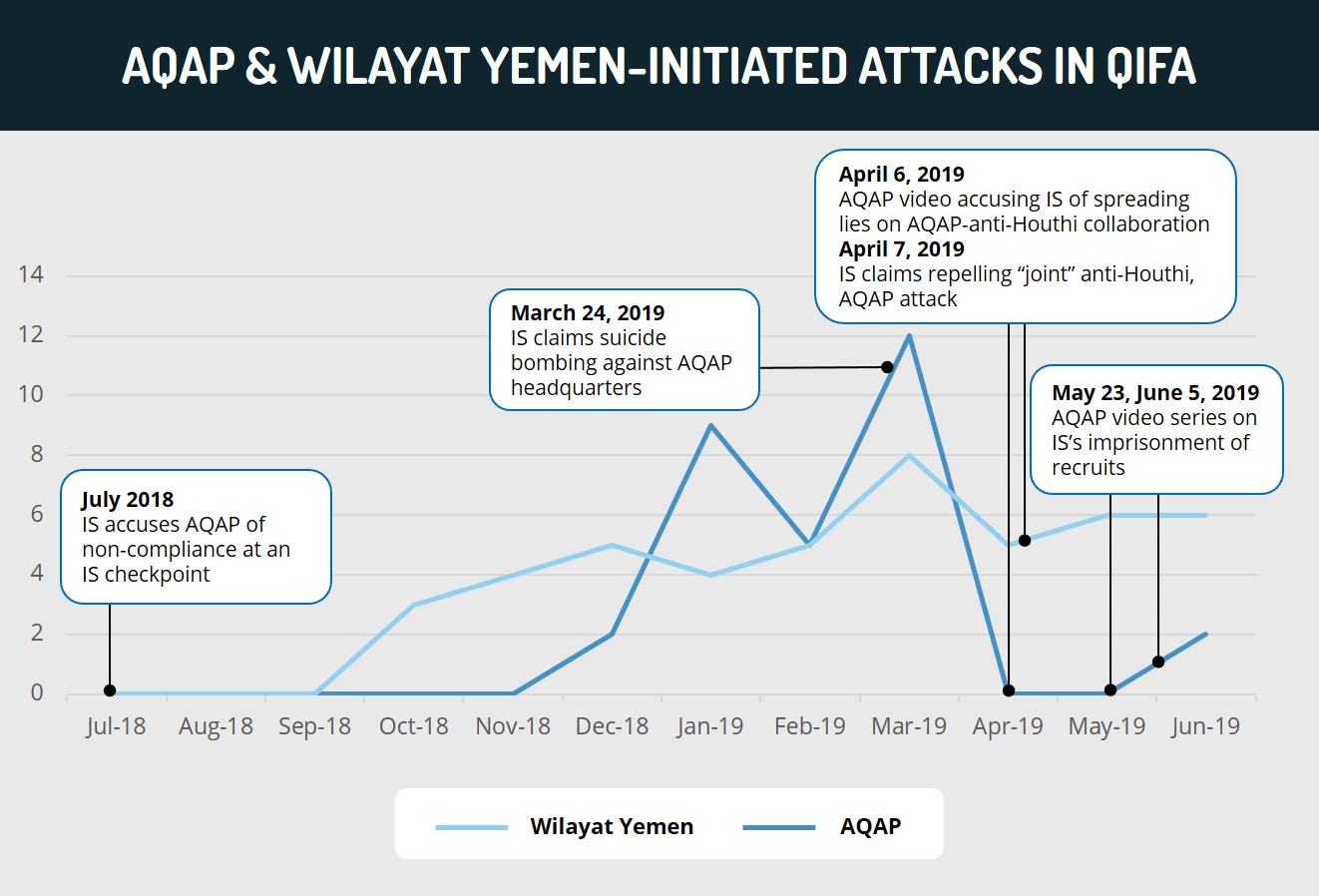

As part of a growing competition for recruits, areas of control, and influence between AQAP and the local IS affiliate Wilayat Yemen in Bayda Governorate’s Qifa area, an uptick in hostile attacks and rhetoric has been recorded during and following the end of March. The most notable developments include the following events:

On March 24, Wilayat Yemen claimed four attacks against AQAP positions in Qifa, including a dual suicide bombing on the latter’s headquarters in Dhi Kalib, which killed over ten AQAP members.

According to reports from April 3, a tribally-supported group aligned with AQAP, “Sons of Qifa,” announced a 5 million Rial reward, equal to around 20,000 USD, for the apprehension or death of a local IS leader Khalid al-Marfadi in March, after the latter destroyed a well and agricultural resources.

On April 6, AQAP released a video on militants defecting from Wilayat Yemen to AQAP, explaining how the IS affiliate started the current conflict with the latter, further accusing Wilayat Yemen’s media of being inconsistent and spreading lies, particularly on AQAP’s collaboration with anti-Houthi forces.

On April 7, Wilayat Yemen suggested that AQAP cooperates with anti-Houthi forces by claiming that it repelled a “joint” attack by AQAP and anti-Houthi forces in Qifa’s Awjah and targeted members of both groups on April 26.

On April 17, AQAP called for a prisoner exchange with the IS affiliate in Qifa.

On April 30, AQAP released a statement denying recent IS claims of having successfully targeted AQAP in Qifa, rather claiming that Wilayat Yemen deployed a child suicide bomber and targeted locals in a supermarket.

On May 23 and June 5, AQAP released issues of a video series on Wilayat Yemen’s imprisonment of its own recruits featuring interviews of members imprisoned for months, only to be released if they agreed to conduct suicide operations against AQAP. AQAP also released images of an IS member accused of spying and who was subsequently thrown from a mountaintop, which AQAP claimed to be sourced from IS’ archives.

On June 14, IS released a video of its offensive against AQAP to take the leadership of global jihad.

Background

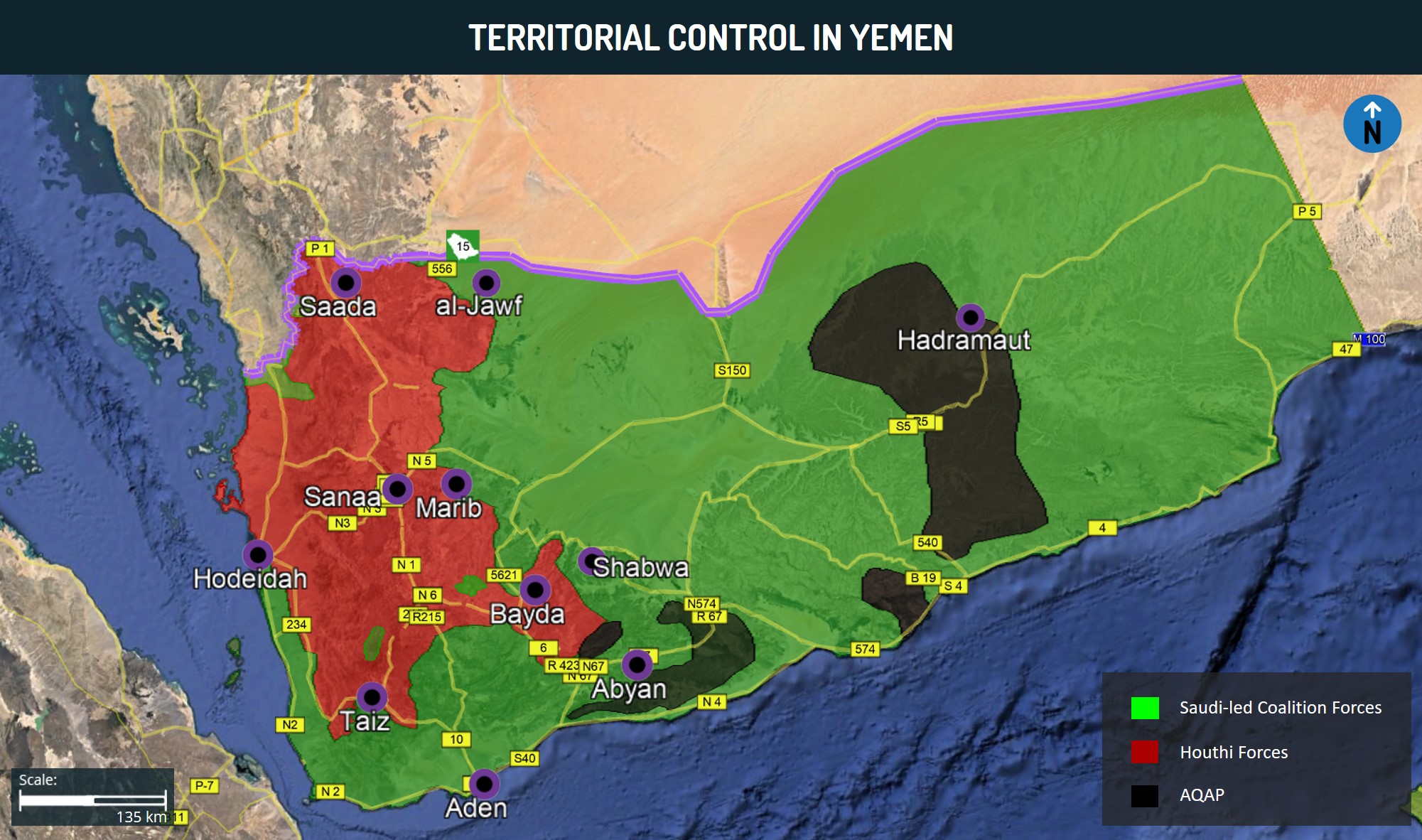

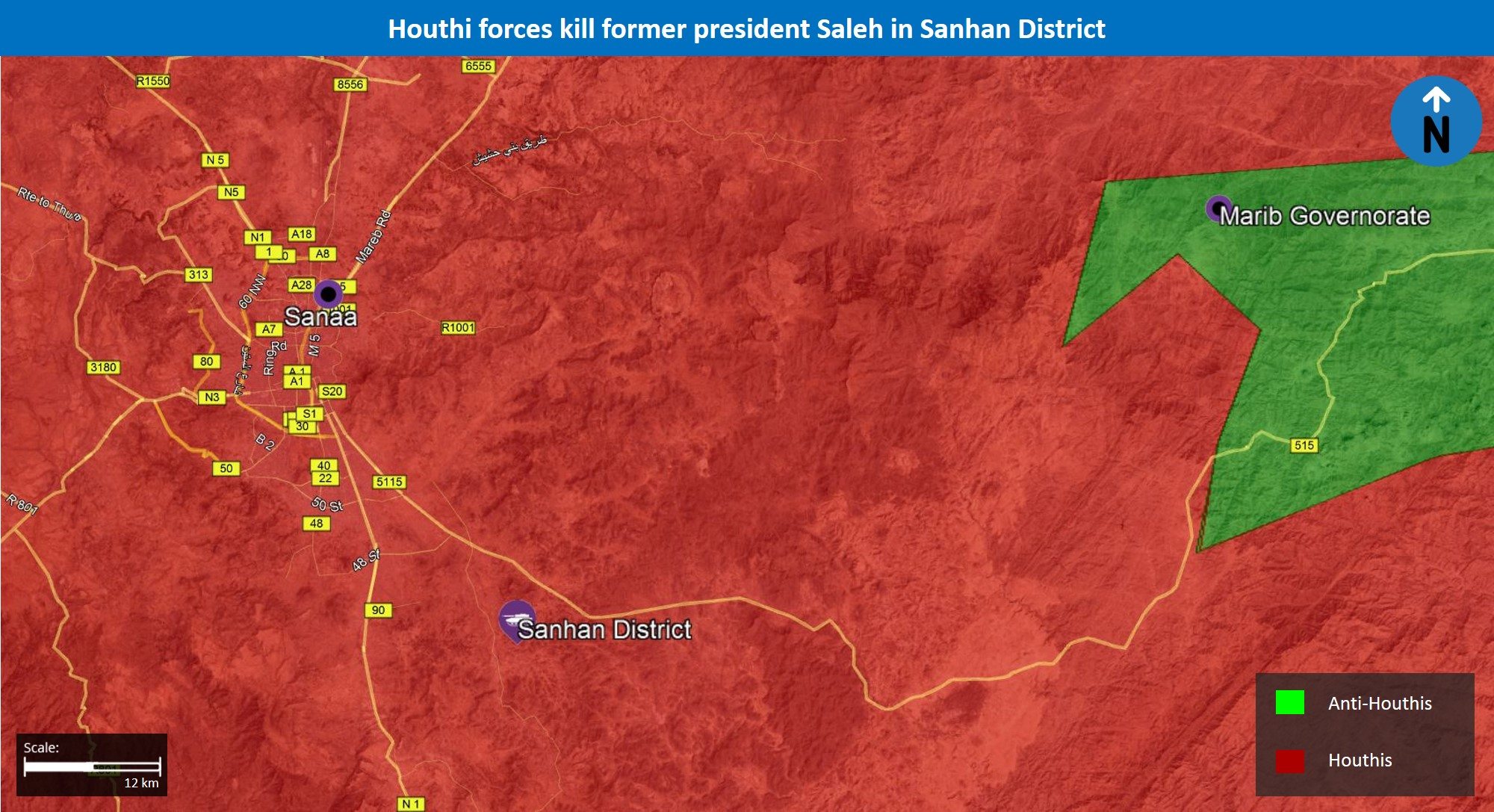

The civil war in Yemen broke out in March 2015, when Houthis forces, allied with former President Ali Abdullah Saleh, took control of the capital city of Sanaa and the southern city of Aden to overthrow President Abdarabbuh Mansur Hadi. This prompted Hadi to flee Aden and seek refuge in Saudi Arabia. Over the course of the month, Houthi forces rapidly took control of areas in several governorates, including Aden, Marib, Bayda, Ibb, and Taiz. This prompted Saudi Arabia to form a coalition comprising of aerial and ground support assets from Egypt, Morocco, Jordan, Sudan, Kuwait, the UAE, Qatar, and Bahrain to launch an offensive against Houthi forces in support of the Hadi-led government. While Iran expressed its official opposition to the Saudi-led Coalition’s offensive in Yemen, it did not explicitly commit to any support for the Houthis initially. However, later in the conflict, Tehran has supplied the Shiite Houthis with sophisticated weapons, in the form of ballistic missiles, unmanned aerial vehicles (UAVs), technological expertise and infrastructure as well as supplies and advisors to bolster their capabilities vis-a-vis the Saudi-led Coalition.

Over the course of the conflict, the Saudi-led Coalition was able to reverse the majority of the territorial gains made by the Houthis. This was particularly following December 2017, when the Houthis killed former President Saleh, which prompted several pro-Saleh factions to rescind their support for the Houthis, significantly overstretching the latter’s ranks and resources. The Saudi-led Coalition currently controls most of eastern and southern Yemen, with small AQAP-help pockets of territorial control in Hadramaut, Abyan, and Shabwa governorates. The Houthis are largely in control of western and northwestern Yemen from Saada Governorate to northern Taiz, Dali, and Bayda governorates. Hostilities continue to be recorded between the Saudi-led Coalition forces and the Houthis across Yemen at the time of writing, with the majority of the fighting taking place in Dali, Taiz, Hodeidah, Sanaa, Saada, al-Jawf, Bayda, and Marib governorates. Both AQAP and IS have managed to exploit the security vacuum resulting from this ongoing civil war in Yemen to strengthen their respective positions.

AQAP

AQAP has successfully managed to expand its base of operations in Yemen over recent years and currently enjoys a considerable presence across the seven governorates of Abyan, Bayda, Hadramaut, Ibb, Lahij, Taiz, and Shabwa. AQAP overall follows the strategy of embedding itself within the Yemeni population and consolidating relations with local tribes. This typically manifests by appearing relatively flexible, for instance, by abandoning the idea of enforcing the full application of Sharia law. In 2016, AQAP started to actively participate in the civil war against the Houthis, alongside local Sunni tribes in various locales, including in Ibb, Taiz, and Bayda governorates, while targeting pro-Hadi forces in Abyan and Hadramaut governorates, further forging local opportunistic relations.

Wilayat Yemen

IS established a presence in Yemen in late 2014 and consisted of various branches that operated in different areas in Yemen, including Wilayat Aden-Abyan, Wilayat Bayda, and Wilayat Lahij. In 2019, IS’ central command announced that these local IS affiliates were merged into one IS branch in Yemen, termed Wilayat Yemen. Currently, the Yemeni IS affiliate’s area of operation is almost entirely confined to the Qifa area located in Bayda Governorate. Unlike AQAP, Wilayat Yemen overall experiences difficulties in gaining local support due to various factors. These largely include locals’ perception of IS as being overtly brutal and conducting indiscriminate attacks against civilians, its lack of effort to embed itself within the local population as well as its overall failure to find culturally nuanced ways of appealing to local tribes, such as their application of Sharia law, which may conflict with local cultures and practices. In addition, Wilayat Yemen is faced with difficulties in receiving foreign fighters, which constitute the majority of its militants, given the challenges facing fighters in reaching as well as integrating in Yemen.

Assessments & Forecast

Intensification of pace and sophistication of attacks in late March

Despite significant ideological differences, AQAP and IS initially largely operated side by side without major hindrances, rather focusing their efforts against the Shiite Houthi forces in the area. Tensions started to rise in mid-2018 due to altercations regarding local territorial and power rivalries between both groups, specifically when IS accused AQAP of non-compliance while passing through one of their checkpoints in Qifa on July 2018. The IS affiliate subsequently claimed its first attack against AQAP in the Qifa area in October 2018, marking a turning point. Such hostilities significantly increased in scope and sophistication towards the end of March. This is highlighted by the increased frequency of attacks and heightened sophistication of the modus operandi employed by both groups during this period, including IS-claimed suicide bombings and AQAP-claimed territorial gains. Prior to that, the two Sunni jihadist groups generally engaged in assaults of relatively low-scale and sophistication, which inflicted a relatively small number of casualties, such as shootings, artillery shelling, and IED attacks. This sequence of intensified hostilities was likely particularly triggered by the IS-claimed dual suicide bombing on AQAP’s headquarters on March 24, which was the first suicide bombing recorded throughout the rivalry in Qifa and resulted in the killing of ten AQAP members.

The intensified attacks by IS likely served to project bolstered capabilities, particularly as its fighters managed to storm the AQAP headquarters and inflict significant casualties. This signaled IS’ increased dedication to challenge AQAP’s presence in the area. AQAP’s response with a string of intensified operations against Wilayat Yemen over the following days, such as the conduct of multiple attacks at an unprecedented pace as well as the capture of IS positions, likely served to retaliate to the attacks initiated by the latter, particularly the symbolic attack against AQAP’s leadership, and to project zero-tolerance to such assaults. AQAP’s claims of taking over multiple Wilayat Yemen positions further highlight the former’s ability to strike the latter with elevated force and effectiveness as well as to respond swiftly to Wilayat Yemen’s intensified attacks. This, in turn, serves to project that AQAP’s upper hand in the region as well as its ability to dislodge the IS affiliate from Qifa.

While no AQAP attacks against IS were recorded during the month of April and two were witnessed in May, the IS affiliate claimed to have conducted 11 operations against AQAP during these months, including two suicide bombings. The persistence of IS-perpetrated assaults against AQAP underscores IS’ apparent view that prioritizing the targeting of AQAP is vital in order for it to maintain its presence and influence in Qifa, as IS likely perceives AQAP as the main threat to maintaining control over the area. This is particularly the case as Qifa constitutes the sole area in which IS retains a level of influence, as opposed to AQAP’s presence across several governorates in Yemen.

Nonetheless, the stark decrease in AQAP-perpetrated offensive operations against the IS affiliate during April and May, despite the continuation of IS attacks, may indicate that AQAP does not view such hostilities as significantly threatening its influence in the region. In turn, this would indicate that AQAP does not prioritize attacks against the IS affiliate. This is further highlighted by AQAP’s reluctance to target Wilayat Yemen following the latter’s initial attacks conducted in October and November 2018. Many AQAP-initiated operations appear to have been conducted in retaliation to IS-led assaults deemed relatively significant by AQAP. This is highlighted by the rhetoric used by AQAP in claims of responsibility issued for two attacks conducted in June, which stated that they were conducted in retaliation to assaults by the IS affiliate.

FORECAST: Overall, hostilities between both Sunni jihadist groups are likely to persist over the coming weeks and months. In this regard, periodic intensified and increased back-and-forth hostilities are liable to be recorded. Given that Qifa constitutes Wilayat Yemen’s only area of influence, the IS affiliate will likely initiate the majority of such hostilities in Qifa and will continue to prioritize AQAP as its main target. That said, while AQAP has significantly reduced its offensives against Wilayat Yemen since March, large-scale attacks by Wilayat Yemen, especially symbolic ones, will likely trigger retaliatory attacks by AQAP to project its dominance.

Intensification of delegitimization efforts

Over the past months, both Sunni jihadist groups, mainly AQAP, have bolstered their online propaganda and recruitment efforts. Therefore, following the numerous operations against the IS affiliate from December 2018 to March, the subsequent lack of AQAP attacks against Wilayat Yemen in the following months may indicate that the group viewed such operations as ineffective in preventing the latter from continuing its attacks. This may have compelled AQAP to adjust its strategy towards adopting alternative means to undermine Wilayat Yemen in Qifa. This has largely manifested through a stream of propaganda material intending to portray AQAP as retaining a moral high ground to the local population, while simultaneously delegitimizing Wilayat Yemen.

One of the manifestations of these efforts by AQAP came through its attempts to depict Wilayat Yemen as brutal, particularly through the imprisonment and treatment of its own recruits, as underscored by AQAP in multiple propaganda publications. This serves to boost the locals’ perception of Wilayat Yemen as unnecessarily cruel in order to deter potential recruits. This was particularly utilized in the video broadcasted by AQAP on June 5, which it claimed to have retrieved from IS’ archives, depicting an alleged member of Wilayat Yemen who falsely confessed to being a spy and was shown being thrown from a mountaintop.

In turn, Wilayat Yemen has largely focused its efforts to delegitimize AQAP through accusations of the latter’s alleged cooperation with anti-Houthi forces. Such claims likely aim at deterring support for AQAP as they also allow IS to depict AQAP as cooperating with a government viewed negatively by segments within the local population. The accusation further serves to portray AQAP as cooperating with elements perceived as corrupt by the IS affiliate. By doing so, Wilayat Yemen is taking advantage of a number of unconfirmed reports released over the past months that indicated that AQAP and pro-Hadi government forces are cooperating in certain areas of Yemen, such as Taiz. The video issued by AQAP on April 6 denying such cooperation highlights the former’s apprehension of the potential traction that this narrative may have among local supporters. Therefore, AQAP is attempting to debunk such claims in order to mitigate their potential negative impact on the organization, which could lead to a decrease in recruits.

FORECAST: Both Sunni jihadist groups will likely continue to seek to establish and maintain a dominant presence at the cost of one another in Bayda Governorate’s Qifa area over the coming weeks and months. Given IS’ persistent attacks against AQAP, along with its lack of local support, Wilayat Yemen will likely continue to focus its efforts on targeting AQAP through violent assaults. AQAP, on the other hand, will likely continue to counter the IS affiliate through its apparent long-term strategy of isolating Wilayat Yemen in Qifa. In this regard, AQAP will likely focus the majority of its effort on spreading propaganda aimed at further delegitimizing the latter in the perception of the local population, while continuing to rally local support for its own cause. In this context, AQAP will likely continue to depict itself as holding the moral high ground vis-a-vis Wilayat Yemen. AQAP attacks against Wilayat Yemen will therefore likely remain relatively less frequent compared to IS attacks against the former. Therefore, the balance of power currently witnessed in Bayda is likely to remain unchanged or slightly sway in favor of AQAP, as AQAP is pursuing more long-term goals of maintaining their partial local support as opposed to IS’ short-term focus on essentially targeting AQAP.

Recommendations

It is advised at this time to avoid all travel to Sanaa and Aden.

In the event of air strikes, it is advised to take cover in a designated shelter, or if one does not exist, in a room with as few external walls, windows and openings as possible, close all openings, sit on the floor below the window line and near an internal wall.

We advise against all travel to outlying areas and overland travel, due to the limited government and security presence, ongoing clashes and airstrikes, as well as the heightened threat of attacks and kidnappings.

For those operating in or conducting business with oil facilities, it is advised to consult with us for itinerary and contingency support plans.

Foreigners, particularly Westerners, continuing to operate in Yemen are additionally advised to maintain a low profile, exercise heightened vigilance, and avoid locales frequented by foreign, particularly Western nationals. To mitigate the risk of attacks or abductions, ensure that places of stay are equipped with sufficient perimeter security details, alter travel routes, and avoid disclosing sensitive itinerary information to unknown individuals.