Executive Summary

On August 4, a large-scale explosion occurred in Beirut, which was reportedly caused by the ignition of ammonium nitrate that was stored at the Port of Beirut. The incident caused mass casualties, prompted significant unrest in the city, and fueled broader widespread anti-government sentiments against alleged endemic state corruption and incompetence.

Against the backdrop of a long-term economic crisis, the incident will force Lebanon to seek external aid, which will have major conditions attached to it that Lebanon may not be able to meet. Additionally, this will alter the geopolitical dynamics of the country.

The incident led to the resignation of the government and will have immense political ramifications for Lebanon, including carrying the risk of a long-term political vacuum, which will trigger further violent unrest, sectarian tensions, and societal polarization.

It is advised to avoid nonessential travel to Beirut at the current time, in light of the increased risk of civil unrest and political instability.

Please be advised

August 4 Explosion

On August 4, a large scale explosion occurred at the Port of Beirut, reportedly caused by 2,750 tons of a chemical compound called ammonium nitrate that was stored in a warehouse at the port and caught fire, before exploding.

The explosion destroyed many buildings in the vicinity of the port and caused widespread damage to much of Beirut.

At the time of writing, the explosion has reportedly killed 220 people and wounded over 6,000 more.

Reports citing Beirut Governor, Marwan Aboud, indicate that approximately 300,000 people were made temporarily homeless by the explosion and that the estimated losses related to the incident may reach 10-15 billion USD.

The ammonium nitrate had arrived in Beirut in 2014 and port officials reportedly made multiple requests for the material to be removed, to no avail.

Domestic Reaction

In the immediate aftermath of the incident on August 4, Lebanese Prime Minister (PM) Hassan Diab stated that he will not “rest until we find the person responsible for what happened.” On August 6, 16 port officials were reportedly apprehended as part of the investigation.

On August 8, Diab announced that Lebanon “cannot get out of this crisis” without early parliamentary election.

On August 7, Lebanese President Michel Aoun indicated that the “cause [of the blast] has not been determined…there is a possibility of external interference through a rocket or bomb”.

On August 7, Hassan Nasrallah, the leader of the Hezbollah militant group, made a televised address in which he categorically denied that the Shiite organization had stored any weapons or explosives at the Port of Beirut.

He added that “if you want to start a battle against the resistance [Hezbollah] over this incident, you will get no results”. He attacked “liars who want to…provoke a civil war” and claimed Hezbollah’s attention is more focused at Israel’s Haifa Port, than Beirut Port.

Since the August 4 explosion, unruly anti-government protests have been held in Beirut. Most notably, on August 8, thousands of demonstrators gathered in Martyrs’ Square and staged mock hangings of President Aoun, Parliament Speaker Nabih Berri, and Hezbollah’s Nasrallah.

The protesters temporarily occupied the buildings of the Economy, Energy, and Foreign ministries, the last of which they claimed as the “seat of the revolution”. During violent clashes that took place at the protest, a police officer was killed and 728 protesters were wounded.

Protesters chanted “all of them, means all of them” and “resign!”, with reference to the removal of the entire political class; “revolution”; and some called Hezbollah “terrorists”.

On August 10, the PM announced his resignation and that of his cabinet. He reportedly stated that “corruption is greater than the state”, attributing “chronic corruption” as the cause of the explosion, and added that the “political class is using all their dirty tricks to prevent real change.” Lebanese President Michel Aoun accepted his resignation.

Background

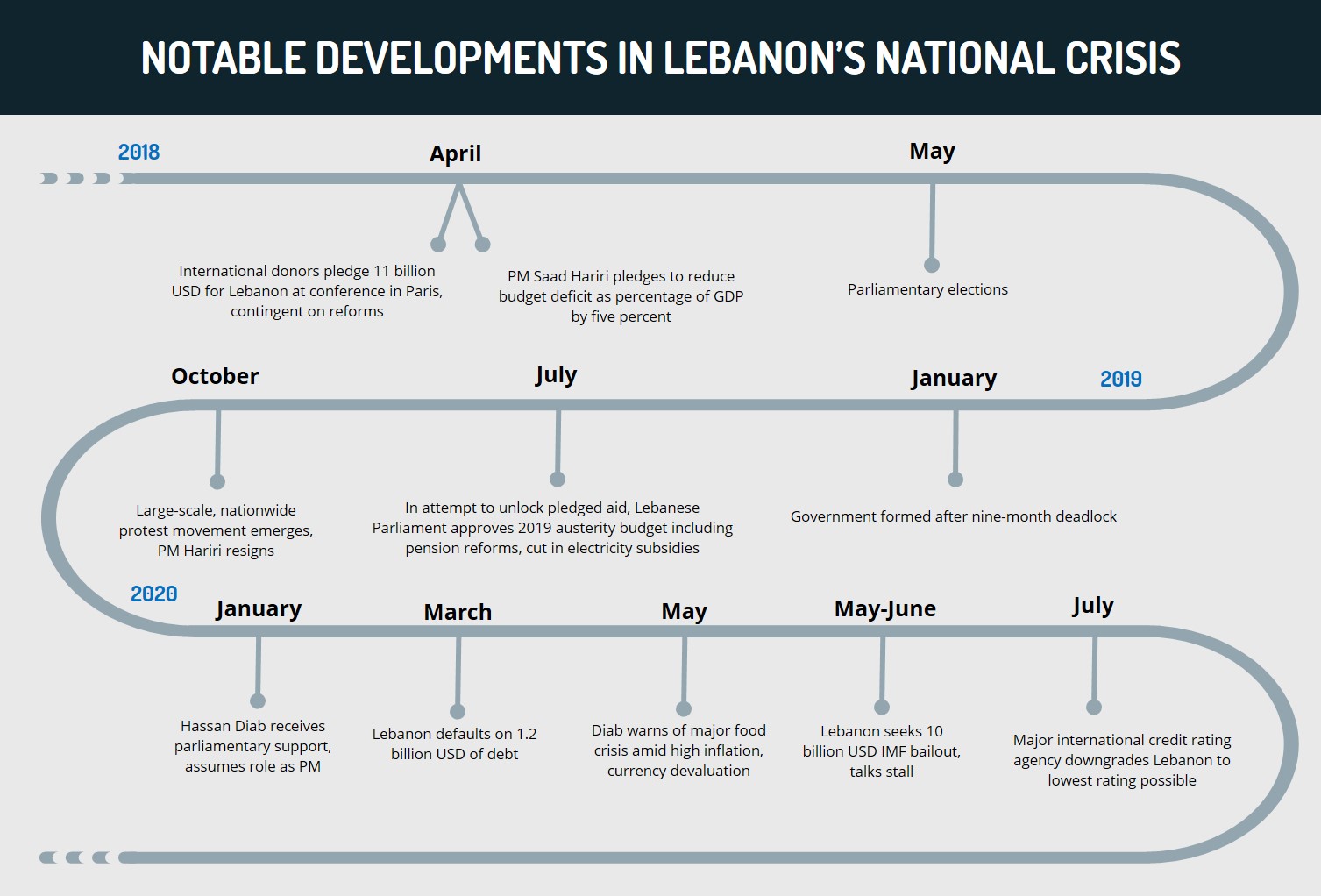

Prior to the explosion, Lebanon was already experiencing a severe, long-term national crisis on several fronts. The economy has been in a dire state for a prolonged period. Public debt in the country has reached approximately 170 percent of GDP, rendering Lebanon one of the most indebted states worldwide. In March, the government defaulted on 1.2 billion USD of debt. In July, the Labor Minister, Lamia Yammime Douaihy, reportedly announced that the unemployment rate had risen above 30 percent, up from 11.4 percent in 2019. The local currency, the lira, has reportedly lost over 80 percent of its value since October 2019. This has led to substantial inflation, including to essential goods such as food, which as of July, had witnessed price increases of 200 percent.

There has also been profound political instability and civil unrest in Lebanon, particularly over the past year. In October 2019, a proposed tax on the use of a cellular call application prompted major nationwide protests. The demonstrators, harboring multiple grievances, called for an end to perceived endemic state corruption and incompetence, and “new era” of transparency and accountability; significant reforms to counter the mismanagement of the economy and poor quality or lack of public services, especially waste removal; the resignation of the entire ruling political class, as illustrated by the “all of them, means all of them” chants; and in some cases, radical reform that replaces the sectarian-based political system with a renewed non-sectarian method that focuses on Lebanon as a whole.

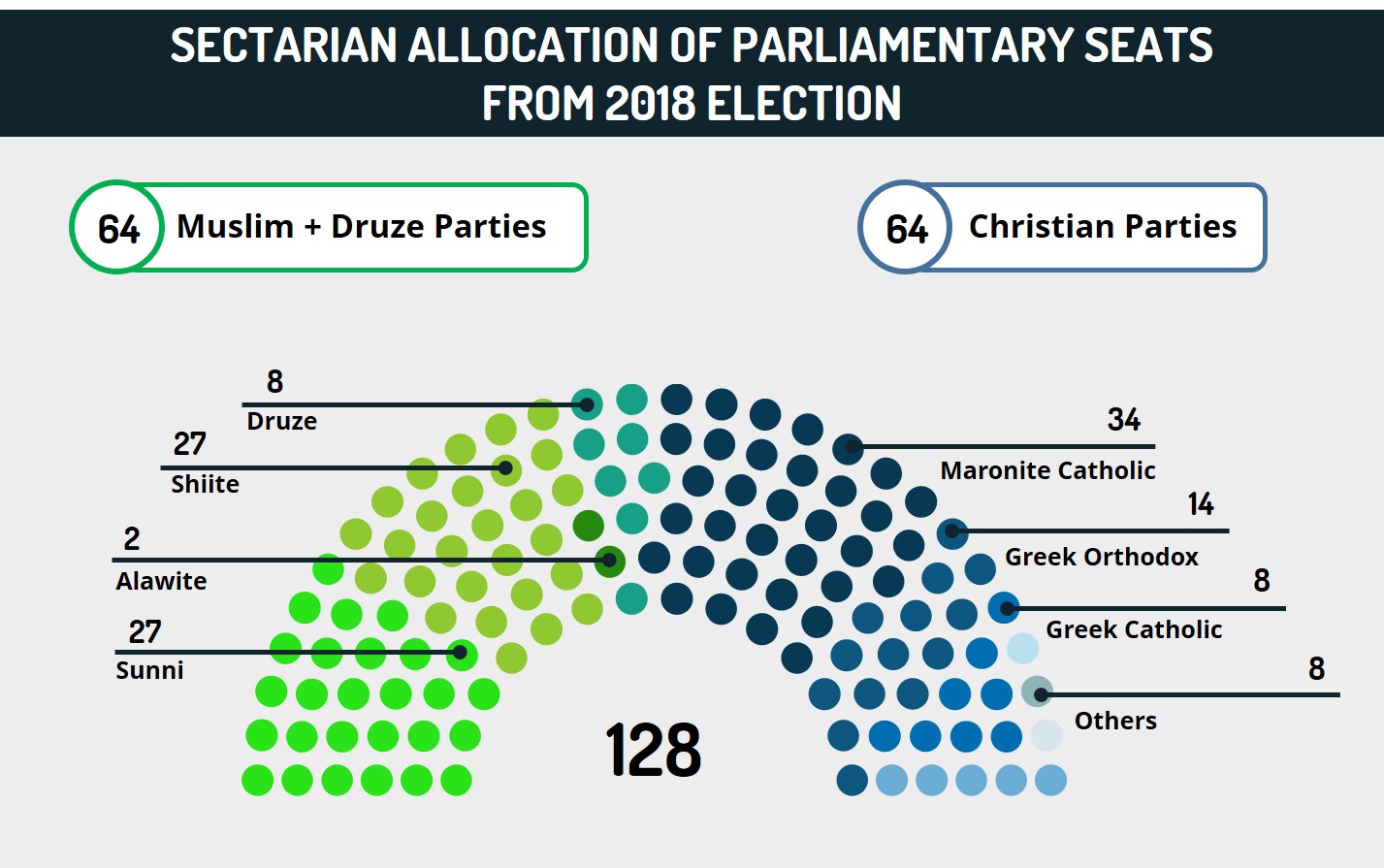

On October 29, 2019, as the anti-government protest movement gained momentum, former PM Saad Hariri announced his resignation. He was replaced in January 2020 by Hassan Diab. In accordance with the Lebanese constitution, Diab is a Sunni Muslim. His candidacy as PM was supported in the Lebanese Parliament by the Hezbollah-allied March 8 Alliance, but failed to receive the support of Sunni parties. He presented the new cabinet as technocratic that would serve the interests of the entire populace of Lebanon. However, the new ministers were widely perceived by the protest movement as continuing to serve sectarian interests. While small-scale demonstrations have continued, the protest movement has subsided in recent months, in part due to COVID-19-related restrictions on gathering.

Assessments & Forecast

Explosion at Port of Beirut to exacerbate pre-existing economic crisis over coming months, force political leaders to seek external support

Over recent months, the aforementioned economic downturn was further aggravated by the COVID-19 pandemic. The global health crisis has had a very adverse impact on the economic situation in Lebanon, which imports approximately 80 percent of its goods. The economy is highly dependent on the services industry, tourism, and remittances from the Lebanese diaspora, which is made up of approximately double the number of citizens currently residing in the country. All of these sectors and sources of income have been majorly hampered by the pandemic due to restrictions on travel and business continuity, which have prompted many financial institutions, companies, and organizations to sever payments and contracts.

This has been further compounded by the severe devaluation of the Lebanese currency, which has rendered it near-impossible for many import-dependent companies to stay afloat. Other sectors of the domestic economy have also been affected as a result, which negatively impacted the wider economy and level of unemployment. For instance, as a measure of economic activity, nearly 1,000 restaurants have reportedly been forced to close during recent months, translating into 25,000 job losses in this sector alone. Taken as a whole, 3.25 million people, amounting to approximately 65 percent of the population, have reportedly fallen into poverty as a result of the prevailing economic conditions in Lebanon. This has manifested in widespread hunger and food insecurity, which PM Diab himself raised alarms about in May, stating that the “coronavirus is pushing Lebanon toward a major food crisis”. Meanwhile, amid dwindling fuel supplies, the country has additionally been experiencing widespread power outages over recent months.

Against this backdrop, the massive explosion at the primary port in a country that imports the majority of its goods is liable to have a profoundly negative impact on its economy and provision of basic goods to citizens. In the short-term, Lebanon will be compelled to rely on other points of entry, such as the Port of Tripoli, for the import of essential goods. These ports have a lower capacity than the Port of Beirut, which will reduce the quantity of goods entering the country as well as the speed at which they arrive. This, in turn, is likely to create further shortages of basic goods and ramp up prices, which will pose more challenges for local residents seeking affordable access to basic goods and services. The situation will be further aggravated by the fact that the August 4 explosion destroyed Lebanon’s sole grain silo, which was located at the Port of Beirut. This issue will become more acute by the government’s reported failure to maintain grain reserves for use in an emergency, which will further aggravate food insecurity in the country.

The longer-term reconstruction process will require substantial capital investment, which Lebanon, already highly indebted, does not possess. This renders any rehabilitation highly contingent on external finance and implementation. Over recent months, in an attempt to revitalize the economy, the government had conducted negotiations with the International Monetary Fund (IMF) to secure a 10 billion USD aid package. The talks with the IMF had stalled prior to the explosion, largely due to Beirut’s failure to satisfy the IMF that it was capable or willing to enact financial reforms to address corruption and budgetary inefficiency. FORECAST: Given this precedent, and a previous 11 billion USD aid package that was pledged to Lebanon at an April 2018 conference in Paris on the condition of reforms that were not fulfilled, the reconstruction process is likely to be drawn out. This will be exacerbated by political and geopolitical tensions pertaining to Lebanon’s preferred affiliation with Western-aligned institutions and states or those that are broadly anti-US, such as Russia, China, and Iran, which backs Hezbollah. As a result of these deliberations and the likely complications in implementing reforms, the heightened levels of uncertainty in Lebanon will render the creation of jobs or large-scale reforms to public services even more difficult.

Although many states throughout the world have offered and delivered humanitarian relief in the immediate aftermath of the disaster at the port, as illustrated by a France-led international summit that raised 297 million USD, the more substantial aid required to rebuild large parts of Beirut and ultimately revamp the economy will require tens of billions of dollars, as highlighted by the Beirut governor’s estimate that the explosion alone caused up to 15 billion USD of damage. FORECAST: In the absence of aid, the economy will remain in recession and plunge further into debt, translating into elevated poverty and unemployment. This will also be likely caused by the perception that Lebanon is fundamentally, both politically and economically, unstable, which will complicate any efforts to attract external investors or tourists, when travel and business operations resume following the COVID-19 pandemic.

FORECAST: Even in the event that Lebanon does successfully secure foreign aid, which will provide a significant boost to the economy and generate some growth, it will still face substantial economic challenges over the coming years. Given the precedent of the 2018 conference in Paris, wherein 10.2 billion of the 11 billion USD aid package was reportedly slated to be granted as a loan, any potential assistance over the coming months is also likely to be in loan form, which will add to Lebanon’s rising levels of external debt. Moreover, the aid will be conditioned on the implementation of financial reforms to the banking and energy sectors, as well as a combination of spending cuts and tax increases in order to reduce the budget deficit. Such reforms have proven extremely difficult in the past due to both opposition by state institutions to make reforms and civil unrest by local citizens in condemnation of austerity measures. Furthermore, although the inflow of capital into Lebanon will help to shore up foreign currency reserves and bolster the state’s ability to provide some services, without measures to strengthen the local currency, the purchasing power of Lebanese companies and citizens will remain limited. Overall, even a potential aid package, which will have multiple conditions attached to it, presents no guarantee of an economic recovery.

Widespread anger, elevated anti-government sentiments to persist, resulting in civil unrest, prolonged political instability over coming months

Significant portions of the Lebanese population perceive the explosion at the Port of Beirut as symbolic of the endemic corruption, mismanagement, and incompetence of their political leadership. The presence of a highly incendiary chemical at the country’s main point of entry for over six years, seemingly without professional or government supervision, which has had catastrophic consequences, has enraged local residents. This is evidenced by the large-scale protests, the mock hanging of prominent political leaders, and calls for a “revolution”. FORECAST: Given that the rehabilitation process in Lebanon is likely to take years to implement, anti-government sentiments are likely to remain high for the foreseeable future, even with a potential change of the incumbent government. Over the coming weeks, in an attempt to capitalize on the ramification of the explosion to drive reforms, further large-scale protests and widespread unrest are likely to take place, particularly in Beirut. However, even when tensions subside, the absolute lack of trust in the national leadership harbored by many citizens, alongside the profound economic crisis, render it likely that protest activity, often accompanied by violence, will continue periodically. This will be exacerbated if the protesters perceive security forces to be employing excessive force.

As the anti-government protest movement strengthens, it is likely that anti-Hezbollah rhetoric at the demonstrations will become more prominent. This has already been evidenced by the chants against the Shiite group since the wave of protests in October 2019, which have continued during the current protests. This was also demonstrated by the extremely rare and notable decision by protesters to stage a mock hanging of an effigy of Hezbollah’s Nasrallah in the center of Beirut. FORECAST: However, the Iran-backed militant organization continues to harbor significant influence and control in Lebanon, especially among the Shiite community that makes up approximately one third of the population. As witnessed during the anti-government protests in 2019, as protesters amplify calls for Hezbollah to disarm and relinquish control over state institutions, the latter’s supporters will likely respond in kind by launching a counter-protest movement. This movement will likely not defend the current government due to its widespread unpopularity. However, it will defend Hezbollah against accusations and demands from anti-government protesters as well as seeking to protect the current political status quo that yields influence to Hezbollah. Thus, a deep polarization of Lebanese society can be expected over the coming months as tensions rise and accusations are hurled at different sectors of society and their respective leaders.

A key part of these tensions will be the degree to which Lebanon’s new government will be willing to lead a comprehensive investigation into the explosion that is perceived by citizens as independent of political interests. In light of the citizens’ significant lack of trust in the political leadership, any inquiry by Lebanese authorities is likely to be met with significant cynicism and attempt to absolve responsibility. The leadership’s narrative would likely be discarded by many citizens, which will give rise to alternative versions of the events that resulted in the explosion and thus more instability. As a result, there have been calls from both within Lebanon and by external actors for there to be an international investigation into the events. However, this is likely to be rejected by many government-linked elements in Lebanon, particularly Hezbollah, due to the perceived international interference in Lebanese domestic affairs and the potential for accusations to be made against the Shiite group regarding its broader alleged placement of explosives and weapons in civilian installations. In either scenario, the investigation is liable to prompt significant political tensions and instability in Lebanon.

The explosion has already had a major impact on the political landscape in Lebanon, as illustrated by PM Diab’s resignation and call for early parliamentary elections, which was one of the key demands of the anti-government protest movement. Thus, for at least the months leading up to the potential elections, the focus of the movement will be trying to affect the potential election’s results rather than broadcasting broad anger against the current government. However, new elections would also be a potential trigger for major political instability for two reasons. Given the precedent of Lebanese elections, in the months following the vote, a long, drawn out process will take place in order to form a viable coalition government that can command sufficient support in the parliament. This is illustrated by the most recent election that took place in May 2018, and only yielded a government nine months later. Second, due to Lebanon’s sectarian system, wherein the Speaker of the Parliament must be a Shiite, the Prime Minister a Sunni, and the President a Christian, as well as the allocated share of the parliament between the country’s various sects, there are inherent obstacles to radical political change, which is desired by protesters. This built-in system is liable to trigger renewed sectarian tensions in Lebanon and potentially sectarian-motivated violence, as will be discussed in the next section.

Hezbollah’s anti-US, anti-Israel rhetoric to increase in attempt to shift blame to external adversaries, liable to increase sectarian issues

As discussed before, the protesters’ anger at the political establishment has either included Hezbollah (“all of them, means all of them”) as part of broad dissatisfaction at systemic corruption or has specifically targeted the Shiite group (chants of “terrorists”). Hassan Nasrallah’s initial reaction to the incident in which he attacked “liars who want to…provoke a civil war” and attempted to absolve the Shiite group of responsibility for the explosion by denying the presence of explosives at the port suggests that the Lebanese militant organization, which is a part of the national leadership, is under pressure at the current juncture. Nasrallah’s reference to Haifa Port amid rising anti-Hezbollah sentiments following the explosion is part of the group’s effort to portray itself as the “resistance”, and by extension, an attempt to detach itself from the ruling political class and its perceived mismanagement of state affairs.

As previously mentioned, the Shiite group continues to harbor influence among significant segments of the Shiite community, as well as parts of the non-Shiite sector. These elements adhere to Nasrallah’s narrative of events and are likely to reject any accusation of wrongdoing by the group in the lead-up to the explosion or condemnations of its border militant activities. However, in the likely scenario that the economic situation deteriorates further and pressure increases on the government, and in turn, Hezbollah, the Iran-backed militant group may seek to divert attention from the domestic crisis by attributing the US and Israel with blame for Lebanon’s demise.

FORECAST: With regards to the former, Nasrallah will likely invoke Washington’s sanctions against Hezbollah and its allies, Iran and Syria, (recently exacerbated under the 2019 Caesar Syria Civilian Protection Act) as the source of Lebanon’s woes. This, in turn, may prompt an increase in anti-US sentiments among some segments of the populace, which, as part of the polarization process, will potentially push the anti-Hezbollah camp to align more with the West. Meanwhile, with regards to Israel, the current explosion has de-escalated recent tensions surrounding an anticipated retaliation by the Shiite group for the alleged Israel Air Force (IAF)-perpetrated killing of a Hezbollah fighter in Syria on July 20. This is likely a short-term de-escalation due to the circumstances, as the Iran-backed militant group will not seek to be perceived as further aggravating Lebanon’s crisis in a potential armed conflict with Israel. Over the coming months, however, should the anti-Hezbollah movement grow stronger and undermine the Shiite group’s hold on the country, it may seek to raise its profile as a “resistance” movement defending Lebanon’s sovereignty by acting against perceived hostile external threats that are “responsible for the country’s plight”, namely Israel.

Hezbollah is also known to leverage the significant control that it exerts at state institutions for its own interests, especially during periods of crisis. For instance, during the coronavirus, the Shiite group has reportedly taken advantage of its major influence at the Ministry of Health, where it nominated the minister, to bolster its support among the broader Lebanese populace. Hezbollah effectively mobilized approximately 25,000 personnel, including physicians, nurses and medics, in the fight against COVID-19. It also reportedly dedicated resources to the preparation of hospitals and medical centers. FORECAST: Thus, Hezbollah may seek to capitalize on the current crisis to improve its reputation among the Lebanese populace as an organization promoting welfare.

Explosion at Beirut Port to exacerbate health crisis amid global COVID-19 pandemic

Even prior to the explosion at the Port of Beirut, the economic crisis was having an adverse impact on Lebanon’s health infrastructure. Reports from July 7 indicate that, due to the lack of electricity and resources, private hospitals in Lebanon were forced to reduce operations to emergency procedures only, including to those requiring kidney dialysis and cancer treatments. Moreover, Rafik Hariri University Hospital, the primary care center for COVID-19 patients, was compelled to turn off air conditioning units in its administrative areas to reduce power use. Other hospitals were reportedly forced to rely on generators to maintain a power supply.

FORECAST: Thus, the blast at the Port of Beirut, which in itself caused major damage to a nearby hospital, will have a substantial impact on Lebanon’s ability to provide healthcare. The treatment of thousands of injured individuals from the blast, many of whom will likely require long-term care, will put additional pressure on the already strained healthcare system over the coming weeks and months. These patients will require medication and other healthcare supplies that will need to be imported from abroad, which will also be complicated by the immense damage to the port. Meanwhile, the aforementioned lack of food security and homelessness in the capital and its surroundings, which will only be exacerbated in the coming weeks and months, will also likely cause disease and illness. This will also place the country’s medical infrastructure under further pressure to function.

FORECAST:This will be compounded further by the likelihood of a COVID-19 outbreak in the country due to crowding, prolonged periods at hospitals where coronavirus patients are present, internal displacement of citizens to other areas of the country who may transmit the condition, and the inaccessibility to various types of needed equipment and supplies. Overall, the August 4 explosion will have a major impact on the already struggling healthcare system in Lebanon, including in the private sector. This will also trigger anger and further grievances among citizens, leading to a general sense of instability in the country.

Recommendations

It is advised to avoid nonessential travel to Beirut at the current time, in light of the increased risk of civil unrest and political instability. This is especially the case in the capital’s southern suburbs, including Dahiyeh neighborhood, in light of the potential for militant attacks, spontaneous Hezbollah checkpoints, and civil unrest.

Due to instability, it is advised to avoid all nonessential travel to Lebanon’s outlying areas, particularly near the Syrian border, the Bekaa Valley, the area south of the Litani River, and Palestinian refugee camps. In such areas there remains an increased risk for sectarian-related attacks and abductions targeting foreign nationals as well as local Lebanese residents.

In light of current reduced capacity of local medical treatment facilities, it is advised to prepare a contingency plan for medical evacuation to nearby locations where appropriate medical care can be provided, such as Cyprus.

It is advised to maintain heightened vigilance in the cities of Tripoli, Hermel, Baalbek, Arsal, Tyre, and Sidon.

Travelers are additionally advised to keep identification and travel documents on their persons at all times, due to the increasing prevalence of Lebanese military or Hezbollah checkpoints in Beirut. When coming in contact with a security checkpoint, comply with the instructions of security personnel, regardless of their affiliation, avoiding behavior which may be viewed as threatening.