Executive Summary:

- On March 23, Israel held its fourth round of parliamentary elections in the past two years, which produced another stalemate. Rather than the left and right, the political fault lines in Israel are currently divided along the pro-Prime Minister (PM) Benjamin Netanyahu bloc and the anti-Netanyahu bloc. At present, neither has been able to form a viable coalition.

- Even if either bloc succeeds in forming a coalition through complex political maneuvering, any potential government’s longevity will likely be limited in time. Therefore, the years-long period of political deadlock in Israel is likely to persist due to the lack of a conclusive outcome.

- The political stagnation will hinder the implementation of a long-term budget and comprehensive government planning, which will disrupt proper governance, cause some economic damage, limit the ability for strategic long-term security planning, and hamper Israel’s foreign relations with key allies.

- This is liable to pose challenges for long-term strategic business operations in Israel, especially those requiring high-level government collaboration. However, regardless of the political situation, essential services and infrastructure remain operational and the country is largely functioning as normal. The highly successful COVID-19 vaccine campaign has significantly reduced restrictions on business and commercial activities, with domestic and foreign companies and organizations able to operate without major hindrance.

- Those operating or residing in Israel are advised to remain abreast of the ongoing political situation, which is liable to result in some challenges to long-term business operations requiring state collaboration. Consult with us at [email protected] or +44-20-3540-0434 for more information.

Implications of the political deadlock

As well as leading to an unprecedented situation in which four elections have been held in the past two years, the political stalemate has had, and will continue to have, an impact on the functioning and governance of Israel in various fields. These range from budgetary and economic issues to foreign relations and long-term security doctrines. Below are the primary areas in which the political deadlock is liable to impact until a conclusive outcome is reached and a stable government is formed.

Economy, budget, and domestic governance

- The political situation in Israel has had an impact on the country’s economic functioning and ability to strategically plan ahead. As a result of the political stalemate, the Knesset has not passed an annual budget or comprehensive spending plans since March 2018, which has hindered the capacity of ministries and other government-funded organizations to operate effectively. This concern has been shared by Israel’s economic leadership, as evidenced by comments on April 9 by Bank of Israel Governor, Amir Yaron, who reiterated that “without a stable government that operates long-term” Israel will not be able to implement a multi-year economic plan to effectively emerge from the COVID-19 health and economic crises. This view highlights the importance of both the formation of a stable and cohesive government as well as its longevity for proper governance and economic growth. This is particularly in light of the pandemic, which had a severe impact on the Israeli workforce, with unemployment reaching a high of 27 percent early on in the health crisis and falling to 9.8 percent by March amid the opening up of the economy. Prior to the pandemic, unemployment had reached a record low of 3.8 percent.

- FORECAST: Payments to furloughed workers in Israel are set to expire at the end of June. Many furloughed workers have preferred to continue receiving state payments instead of returning to the workforce and will thus likely be compelled to return to part-time unemployment when these payments end in June. That said, parts of the population will likely remain indefinitely unemployed. This will require government-funded training programs and investment, potentially in cooperation with the private sector, to assist these individuals to reenter the workforce. This is especially because several sectors, particularly those depending on tourism, continue to operate at lower than pre-pandemic capacity and there are therefore fewer jobs in these fields. In the absence of a stable government able to strategically implement such initiatives, hundreds of thousands of people are liable to be in a precarious final situation, which will place strain on the government and the wider economy as their consumption will be reduced.

- The political situation has partly impaired Israel’s ability to respond to pressing needs in a timely manner. This is most saliently evidenced by a reported delay in Israeli payments to vaccine production companies as the Israeli cabinet has not convened to pass this budget due to political infighting in the current Likud-Blue & White caretaker coalition. This is due to the cancellation of a cabinet meeting by Defense Minister Gantz as a result of Netanyahu’s alleged refusal to permit the appointment of a Justice Minister, which also hinders the Knesset’s ability to pass key legislation. The void in the Justice Ministry is one of multiple senior roles, including in the security and defense sectors, that have not been filled due to government infighting. The fact that this led to Gantz’s cancellation of the cabinet meeting underscores the potential for multiple other issues of an important and strategic nature to be hindered or delayed due to political stagnation. The ministers were slated to vote on a 2.1 billion USD procurement of new vaccine doses, which is essential for Israel to sustainably combat the COVID-19 pandemic over the long-term and keep the economy open and thus provide crucial income for individuals and revenue for the state. FORECAST: Although the government will likely find a solution to this specific issue, the development highlights multiple aspects of the current political impasse on proper governance.

- The failure to pass a budget has impacted the government’s capacity to fund infrastructure projects and major national initiatives. This has affected multiple sectors and fields. For instance, the lack of a budget hindered the start of the academic year as the Knesset was forced to pass a special budget in order for schools to open while other state-funded educational services were impacted. More generally, the lack of a long-term budget poses challenges in terms of structural economic reforms and for ministries to provide essential services, including physical and mental healthcare, social provision, and education, which require increased investment in order to meet rising inflation and demand.

- FORECAST: Although the government has managed to pass a series of short-term spending plans and special budgets to cover specific needs, the longer the political deadlock continues, the more that certain services and infrastructure plans will be impacted. Furthermore, even if a coalition is formed, if its primary components lack a shared vision beyond replacing the current Netanyahu-led government, this will also hinder state funding and the passing of a viable long-term budget due to disagreement over policy and economic priorities. Taken as a whole, the political situation will continue to have a relative impact on the functioning of the state over the coming months at least. It may also reduce the desire of international firms to commit to invest and set up offices in Israel until a stable government is in place that can facilitate such operations and work in collaboration. This is also evidenced by a warning by an international credit ratings agency from March 31 indicating that while the present situation does not pose immediate risks to Israel’s economic rating, shown by the fact it kept Israel’s credit rating at AA-, if the political situation persists, it will elevate the fiscal risks due to the difficulty in reducing the deficit. Bank of Israel governor Yaron reinforced this concern, stating that “credit ratings companies are worried by the government’s instability and the failure to pass a budget.”

- Regardless of the political situation, essential services and infrastructure remain operational and the country is largely functioning as normal. The highly successful COVID-19 vaccine campaign has significantly reduced restrictions on business and commercial activities, with domestic and foreign companies and organizations able to operate without a major hindrance. FORECAST: The political stagnation in the country is more likely to pose a challenge to foreign companies potentially seeking to initiate major investments or launch large-scale projects within Israel. This is because government ministries face both budgetary issues and obstacles in the decision-making process. This may also affect collaboration with ministries or state-funded organizations, but routine operations of existing companies within Israel will continue regardless, albeit delays can be expected when receiving permits, regulatory approvals, or other activities that depend on legislation.

Foreign Relations

- The political situation is also somewhat affecting Israel’s ability to forge relations and gain international influence. As a result of political infighting, the current caretaker government, even when it managed to convene on a fairly regular basis, struggled to project a united message to the international community regarding Israel’s policies as senior members of the Likud and Blue and White parties frequently undermined each other. This is particularly the case in sensitive issues of foreign and defense policy, with the latter portfolios being held by Blue and White’s Gabi Ashkenazi and Benny Gantz, respectively, but many diplomatic and security matters being directed by Netanyahu. These competing points of authority have likely posed problems for various states when dealing with Israel. FORECAST: The failure to establish a viable and stable government led by ministers appointed for the long-term will likely pose a challenge for Israel’s efforts to forge relations in essential sectors such as trade and commerce. Foreign governments may be reluctant to commit to such agreements with caretaker officials, while the latter may be restricted by legal obstacles placed upon an interim government.

- The current impasse has resulted in a situation wherein 36 new ambassadorial appointees, which have been approved by Israel’s Ministry of Foreign Affairs (MFA) appointments committee are not yet fulfilling their roles. This situation has been ongoing since November 2020 and many of the ambassadors are reportedly ready and set to be posted on diplomatic missions on an immediate basis. Reports state that this delay is due to a refusal by Netanyahu to bring their approval to the cabinet for its consent. The absence of new ambassadors is a significant issue that is liable to harm Israel’s diplomatic, trade, and security interests. This situation can hinder Israel’s ability to conduct diplomatic campaigns and strategic discourse with other international actors as well as to advance visits of economic delegations to other countries.

- Most importantly for Israel, the lack of government can undermine the country’s relations with key strategic allies such as the US. Continued political paralysis within Israel has likely somewhat hindered its ability to build strategies and coordinate with its allies on matters of essential policy and national security. This is because these allies may be reluctant to engage in long-term planning in the absence of a stable government, especially one that may be perceived as volatile and potentially liable to fall as soon as a political crisis emerges. This may impact Israel’s positions on the Iranian nuclear agreement, especially amid international efforts to revive the Joint Comprehensive Plan of Action (JCPOA); and any US engagement with the Palestinians.

- Another area that the political situation can impact in terms of foreign policy is the pre-election, US-brokered normalization trend that was recorded, consisting of diplomatic agreements between Israel and four Arab states (the UAE, Bahrain, Sudan, and Morocco). These deals are extremely important and strategic for Israel’s diplomatic, security, and economic interests as they enable Jerusalem to garner additional international support against its adversaries and forge trade and investment relations. FORECAST: This trend is likely to slow down or be suspended altogether in the absence of a stable Israel government that other potential Arab states perceive to be a long-term partner. The regional actors that are most likely to reach a normalization agreement with Israel tend to be relatively risk-averse and attach great importance to stability. Thus, if the political deadlock continues or an unstable government is formed, further normalization agreements are unlikely.

Security

- In terms of security, the political deadlock will have an impact on the procurement of military hardware and weaponry. It may also impact the development of advanced security doctrines based on these weapon systems and long-term, large-scale organizational planning. This is due to various budgetary obstacles and challenges posed to the decision-making process. However, over the past two years, despite the political stalemate, Israel has continued to act to safeguard its security interests across multiple arenas. Military activity, both overt and covert, has been reported in various theaters of operation throughout the Middle East region. That said, although these operations are informed by a guiding strategy that has been formulated by previous governments and continues to be updated by Israel’s security agencies, especially vis-a-vis the regional threat posed by Iran and its proxies, the lack of a cohesive government is liable to affect proper governance and the decision-making process. This is shown for instance by the Israeli government’s apparent lack of strategy regarding the best way to manage the threat of militant groups based in the Gaza Strip, which is an issue that periodically emerges with a potentially decisive operation indefinitely put on hold until a stable government is formed. Taken as a whole, despite the political situation dictate, Israel can continue to respond to any threats to its national security and continue to formulate a military strategy to defend these interests.

- FORECAST: This situation will impact Israel’s security in the strategic realm and possibly lead to long-term damage as Israel’s adversaries can gain an edge on delays to procure and develop weaponry due to budgetary and decision-making challenges. However, the ability of Israel’s security apparatus to mitigate and thwart security within Israel itself will remain intact over the coming period. The Israeli security agencies have proven during this period of relative political instability and throughout periods of far greater security volatility that the vast majority of local and regional threats, namely along its northern borders and vis-a-vis Palestinian militants in the West Bank and Gaza, are manageable. Thus, the political situation will not lead to a fundamental destabilizing of the security environment within Israel over the coming period.

Election Results and Political Blocs

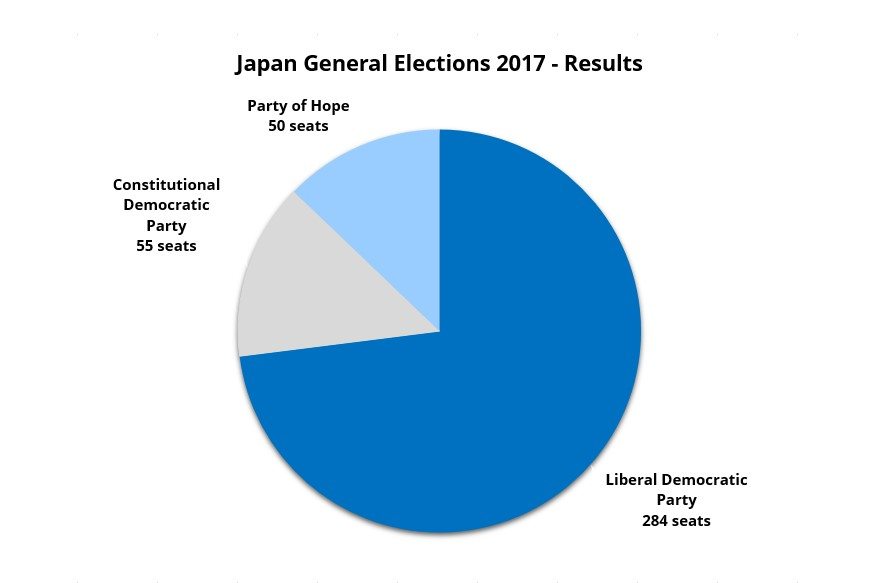

- On March 23, Israel held its fourth round of elections for its parliament (the Knesset) in the past two years.

- During this two-year political deadlock, a government was formed in May 2020, which was led by Prime Minister (PM) Benjamin Netanyahu and the Likud party alongside Benny Gantz, his political rival from the“Blue and White” party. The government’s functioning was hindered by in-fighting and discord between the rival political factions, which eventually led to the dispersal of the Knesset in December 2020, resulting in the March election.

- The results of the election can be seen below. The political fault lines within Israel since the first election in March 2019 have revolved around the parties’ willingness to join or rejection of a government led by PM Netanyahu, who is on trial having been officially indicted in November 2019 for breach of trust, bribery, and fraud.

- The debate on Netanyahu’s political and legal status has transcended the traditional left-right discourse within the Israeli political landscape. In this context, parties that are part of the right-wing political camp in Israel, such as former Likud member Gidon Saar’s “New Hope”, have formally declared themselves to be part of the “anti-Netanyahu” or “change” bloc. Other parties, such as Naftali Bennett’s right-wing “Yamina” and Mansour Abbas’ Islamist “Raam”, remain unaffiliated with either of the pro- or anti-Netanyahu blocs.

- This has resulted in a situation that neither the pro-Netanyahu bloc, primarily made up of right-wing and religious/ultra-Orthodox parties nor the ideologically diverse anti-Netanyahu bloc has been able to form a coalition, which requires a 61-seat majority in the Knesset.

- On April 6, Netanyahu was given a four-week mandate to form a government by President Reuven Rivlin. He has until May 4 to try to assemble a viable coalition and can thereafter request a 14-day extension at the discretion of the president. If he fails, Rivlin can ask a second person or return the mandate to the Knesset. If these alternatives fail to yield a government, the Knesset will automatically dissolve and another election will be held.

Affiliations of political parties

These are the various political parties and their affiliations and policies.

Main options for government coalitions – likelihood and longevity

Option 1: Pro-Netanyahu bloc & Yamina government plus Raam external support in Knesset

- Prime Minister: Benjamin Netanyahu

- Coalition Components: Likud, United Torah Judaism, Shas, “Religious Zionism”, and Yamina (59 seats)

- External support for government votes: Raam (4 seats)

Analysis:

This option is somewhat feasible as it includes various political parties with broadly similar ideological agendas and worldviews in government. Although the Raam party would likely not be a formal part of the government, but an external support bloc, its inclusion poses the greatest challenge to the formation of the government. The “Religious Zionism” party has explicitly stated and reiterated that it will not be part of a government that depends on Raam’s support and this is likely to hinder any progress on this option. This is compounded by major concessions that Netanyahu may have to make to Bennett for the latter to join a government led by the former. In terms of longevity, the Raam party’s leadership is able to cooperate with the religious factions in this potential government, particularly over social policy and support for religious institutions. However, its overall Islamist agenda and links to the Palestinian cause are liable to create complications for the government’s functioning, which would be exacerbated during periods of escalation or religious sensitivities.

Option 2: Pro-Netanyahu bloc & Yamina government plus defectors from the anti-Netanyahu bloc

- Prime Minister: Benjamin Netanyahu

- Coalition Components: Likud, United Torah Judaism, Shas, “Religious Zionism”, Yamina + 2 members of anti-Netanyahu bloc shift allegiances (61 seats)

Analysis:

This government is unlikely due to the reluctance of members of the center or center-right parties to renege on their pledges not to join a government led by Netanyahu amid his indictment on corruption charges. The “Blue and White” party has insisted it will not join a Netanyahu-led government following its previous power-sharing experience with the incumbent prime minister while “New Hope” members, more likely to defect, have so far insisted they will not join the pro-Netanyahu bloc. Although individual members of these parties may choose to join Netanyahu under the pretext of preventing another round of elections, the parties themselves are unlikely to do so due to the potential for a fifth vote and the impact this would have on voters who will perceive this as the violation of election pledges. In terms of longevity, a government made up of the Netanyahu bloc, Yamina, and two defectors from the anti-Netanyahu bloc would likely be more stable on key policies than a Raam-backed coalition. However, with legislation pertaining to Netanyahu’s legal complications, this government would likely face substantial hurdles as several members of Yamina and most potential defectors are unlikely to support any perceived efforts by Netanyahu or his supporters to release him from or evade the legal process.

Option 3: Anti-Netanyahu bloc plus external support from Raam

- Prime Minister: Naftali Bennett/Yair Lapid (Rotation)

- Coalition Components: Yesh Atid, Blue & White, Yisrael Beitenu, Labor, Meretz, Yamina, New Hope (58 seats)

- External support for government votes: Raam (4 seats)

Analysis:

In terms of the likelihood of formation, this government faces multiple challenges due to the ideological diversity of the parties it would include and the pressure within both the left-leaning (Yesh Atid, Labor, Meretz) and right-leaning factions of the potential coalition (Yamina, New Hope) to extract concessions from the other. The former parties seek to ensure Yesh Atid’s Labor is the prime minister (PM) or first in any rotation, while the latter right-leaning bloc insists on Bennett as PM and first in the rotation. The right-leaning parties will also aim to block the left-leaning parties from holding key cabinet posts and thus advancing a left-wing agenda as well as blocking their entry to the security cabinet. Even if this government does materialize, it would likely be hindered by major in-fighting and its longevity is thus very low.

Option 4: Netanyahu chooses/forced to sit aside; right-wing government formed

- Prime Minister: Consensus among right-wing parties

- Coalition components: Likud, Shas, United Torah Judaism, Yamina, New Hope, Religious Zionism (65 seats)

Analysis:

This option is extremely unlikely due to Netanyahu’s widespread popularity among the Likud party and the Ultra-Orthodox parties that support the Likud. Members and voters of these parties would consider any attempt to coerce Netanyahu to step down as anti-democratic, which would create major tensions within Israeli society. Netanyahu also continues to hold significant support among parliamentarians in his and other supporting parties, while even some of his detractors may oppose legislation that prevents him from being prime minister due to its targeted nature. This is evidenced by the failure of anti-Netanyahu parties to pass such legislation over the past years despite their overall opposition to his continued premiership. Taken as a whole, this option is highly unlikely and its longevity is thus negligible.

BOTTOM LINE

Overall, given that all of the above-mentioned options pose considerable challenges to political actors in terms of both the formation of a viable coalition and the longevity of any government, the most likely scenario is either a fifth election with a similar outcome along pro- and anti-Netanyahu lines or an unstable government that fails to complete its term and thus elections are again called.

Recommendations:

In light of the current situation:

- Those operating or residing in Israel, or seeking to do so, are advised to remain abreast of the ongoing political situation, which is liable to have an impact on business continuity.

- It is advised to allot for obstacles to cooperation with public sector bodies and ministries as well as other state-funded organizations.

- Allot for disruptions to processes that require government permits, regulatory approvals, or other activities that are liable to depend on legislation.

- More generally, allot for continued restrictions on entry to Israel due to the COVID-19 pandemic. Consult with us at [email protected] or +44-20-3540-0434 for guidance on entry to Israel amid the current limitations.

General Recommendations:

- Travel to Israel may continue at this time while adhering to security precautions regarding militant attacks, while avoiding the immediate vicinity of the Syrian, Lebanese, and Egyptian borders, due to the persistent risk for cross-border violence.

- Those traveling in the 40 km area surrounding the Gaza Strip should continue adhering to all safety precautions regarding early warning sirens for incoming rockets. Remain cognizant of the situation along with the Lebanese and Syrian border areas, as minor hostilities between various groups can escalate into a broader conflict. In case you hear a siren, seek shelter in a protected area and remain inside for at least 10 minutes.

- In major Israeli cities, remain vigilant in crowded commercial areas or public transport hubs, as these locations have been targeted by militant groups in the past. Alert authorities to suspicious, unattended packages in these areas.

- As a general precaution, avoid nonessential travel to the vicinity of Jerusalem’s Old City, particularly in the vicinity of Damascus Gate, due to the increased potential for acts of militancy and civil unrest. For those seeking to travel to the Old City, it is advised to contact us for a security-oriented travel guide.