Executive Summary

- The government signed an agreement with the SPLM-N al-Hilu rebel group that notably established a shift toward a secular government. Major social reforms have enabled progress in the peace process but have also triggered pushback from conservative elements of society.

- Efforts to incorporate all rebel groups in the peace process into a joint force with the Sudanese security apparatus is likely to be difficult and delayed, with the situation to remain volatile in Darfur.

- The military’s willingness to divest from the economy in some sectors will bolster the government’s efforts to open the country’s markets to private and foreign investment. However, military elites will likely remain heavily involved in newly privatized industries.

- Economic reforms including the removal of subsidies, devaluation of the Sudanese Pound, and allowing non-Islamic banking will likely have positive effects in terms of economic growth and enabling foreign investment.

- The government is expected to struggle in persuading the public that the reforms will take time to take effect and the subsidy cuts in particular will be unpopular. Protests over the economic situation are thus expected to persist over the coming months.

Current Situation

- On March 26, the World Bank stated that the Sudanese government had cleared its arrears and would now be able to secure financing from the World Bank Group and other multilateral institutions under the Heavily Indebted Poor Countries (HPIC) initiative. This was made possible by a 1.15 billion USD bridge loan from the US government on January 6 that was specifically intended to help clear Sudan’s debts.

- Sudan’s inflation rate rose to 341 percent in March according to the Central Bureau of Statistics, despite the implementation of subsidy cuts and currency devolution. These measures and the rising cost of living has led to recurrent protests in Khartoum and other cities.

- On March 29, the government and the Sudan People’s Liberation Movement – North (SPLM-N) faction led by Abdelaziz al-Hilu signed a Declaration of Principles (DOP) in Juba, South Sudan.

- The parties agreed that: “No religion shall be imposed on anyone and the State shall not adopt any official religion.” The state will also “guarantee freedom of religion” and “these principles shall be enshrined in the Constitution”.

- The DOP also stated that the government will sanctify human rights, including for women and children, and take adequate measures to accede to international and African human rights charters that are currently unratified.

- In addition, the SPLM-N al-Hilu and the government agreed to the formation of a “single apolitical professional army” beginning with the gradual integration of rebel forces.

- The Sudan Liberation Movement led by Abdelwahid al-Nur (SLM-AW) had a leadership figure meet with the government in Khartoum on April 3. However, the rebel group released a statement on April 29 stating that it is not interested in negotiating with the current authorities or cooperating with the South Sudanese mediation team.

- Sudan’s Security and Defense Council said on April 10 that it is seeking to form a joint force of 20,000 government troops and rebel fighters drawn from peace agreement signatories to deploy in Darfur. This was decided upon after large-scale intercommunal clashes in El Geneina, West Darfur State on April 3-6 resulted in hundreds of casualties.

Assessments & Forecast

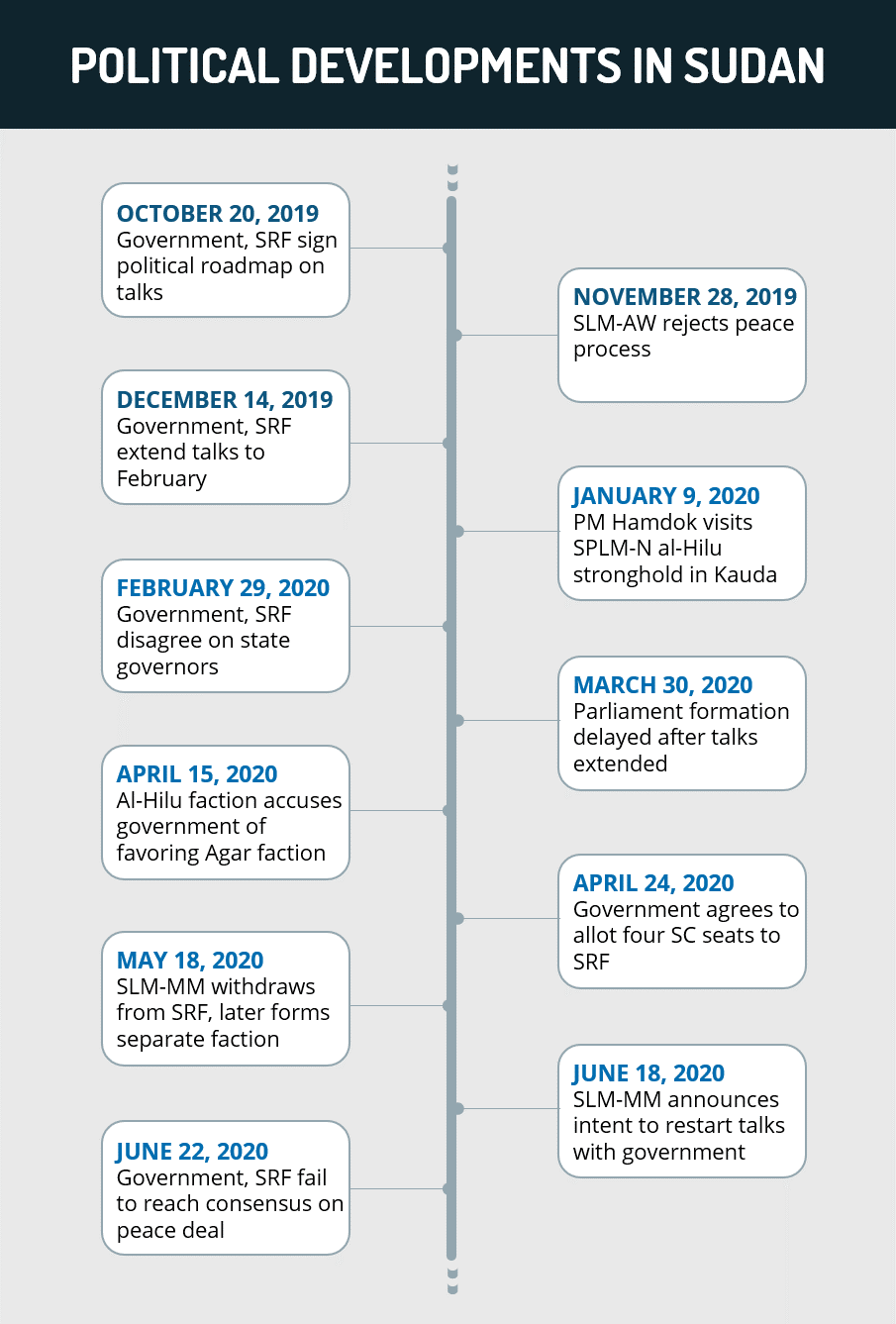

Agreement to separate state & religion regarded as landmark advance of transition, peace process

- The signing of the declaration of principles between the Sudanese government and SPLM-N al-Hilu is a historic step and significantly advances the political transition and peace process. This follows the signing of a comprehensive peace deal with the Sudanese Revolutionary Front (SRF) in August 2020 and signifies continued positive momentum in bringing rebel groups into the mainstream. Coming to an agreement with the SPLM-N al-Hilu is important as the group controls substantial tracts of land in the Nuba Mountains and Blue Nile State, and this will help stabilize the region. A major stumbling block had long been that al-Hilu consistently maintained that a secular Sudanese state is required as many of the population in the group’s territory is Christian and animist, unlike the majority of Sudan. The Sovereign Council’s decision to accede to this demand is highly notable given the country’s long Islamist identity.

- The Sovereign Council likely also decided to agree to a separation of religion and state as a means to garner favor with the international community, who have largely welcomed the agreement as a sign of Sudan’s intent to accelerate democratization and instill liberal values. This would also further sideline the National Congress Party (NCP), which was the ruling party under former President Omar al-Bashir and had enshrined religious principles and the use of Sharia law in state jurisprudence. This comes as a broader shift toward secular governance during the transition. This was best exemplified by the repeal of the “Public Order Law” in November 2019 that had allowed for harsh penalties, including death, for women whom authorities deemed to be violating social norms. The government’s notably decisive actions to institute social changes, particularly for women, have also met international favor. The commitment to these changes was underscored by the transfer of the Khartoum police chief to a minor political post on March 28 after he called for the reinstatement of the Public Order Law, with the government releasing a statement rejecting his call.

- FORECAST: Given the wide-ranging social impact of these reformist policies, there will continue to be pushback from conservative segments of society and government. In addition, the youth and women who led the 2019 revolution and turned away from Bashir’s Islamist policies often tied those policies to the widespread corruption in the government. If the transitional government is able to provide basic services to its citizens and tackle corruption, the move away from Islamic jurisprudence is likely to be accepted more optimistically by the population. However, if the government is unable to deal with these systemic issues, a new set of religious leaders may galvanize a movement toward reinstating Islamic law as a means to achieve these social objectives. In that sense, the popularity of social reforms is tied heavily to the overall perception of the government’s progress.

- In addition, Islamist elements within the country who are supportive of a return to Sharia-based governance such as the Muslim Brotherhood and the disbanded NCP would likewise aim to support any move to roll back social reforms. FORECAST: This support is likely to be in the form of protests against the transitional government, which would be suppressed by local authorities that have consistently prioritized maintaining public order. Conservative leaders are likely to use Islamist sympathizers within the bureaucracy and security agencies, such as the former Khartoum police chief, to push for a return to more religious social norms. Such practices are likely to be the biggest challenge facing the government in its attempts to secularize governance in the coming months and could raise tensions over what is considered acceptable conduct in public spaces.

Efforts to launch unified joint force in Darfur likely to be difficult, delayed

- With the new agreement with the SPLM-N al-Hilu, nearly all major rebel groups have been officially demobilized and slated to integrate into the new security structure, with the exception of the SLM-AW operating from Jebel Marra. Regardless, in the wake of large-scale intercommunal violence in El Geneina in early April, the Security and Defense Council announced plans to create a new joint force composed of the Sudanese Armed Forces (SAF) and fighters of signatory rebel groups that will be capable of “rapid intervention” across Darfur. This has been a long-awaited step in fulfilling the August 2020 peace accords, which would be crucial to stabilizing Darfur and ensuring the success of the transition in the periphery. FORECAST: However, it will likely face significant challenges in implementation and authorities have yet to release any clear timeline for the plan or indication that funding has been allocated to this project.

- The work of unifying the force will be difficult given longstanding intercommunal hostilities. While a force with representation from Arab and non-Arab tribes will be promoted as a mechanism to build public confidence in the security forces and increase inter-ethnic cooperation, it will also likely be fraught with tensions, internal divisions, and disputes over organization and leadership. The prime example of this may be the role of the government’s Rapid Support Forces (RSF) paramilitary, whose origins are in Arab militias implicated in atrocities in Darfur. These militias fought the war against the rebel groups that will now integrate into the joint force and there is likely to be significant mistrust that could jeopardize cooperation. This will likely demand intensive reconciliation and confidence-building measures, and it is unclear if the government has the capabilities to do this.

- The need for increased security deployments in Darfur has particularly been emphasized since the December 2020 withdrawal of the UN – African Union Hybrid Operation in Darfur (UNAMID) peacekeepers. Although the RSF has launched its own “Peace Shield Forces” initiative to fill the security vacuum, this has been controversial in areas that have been victimized by RSF militias in the past. RSF operations without the SAF or rebel fighters risk stoking further intercommunal violence, and this can cast further doubt on the eventual ability of all of these parties to eventually integrate.

- FORECAST: With the joint force in its infancy, the SAF is expected to continue to enforce state of emergency measures in conflict zones across Darfur and mitigate further large-scale intercommunal violence. With this, local civil society groups and professional organizations are likely to continue sit-in protests in El Geneina, El Fasher, Nyala, and other cities across Darfur to demand improved security and government accountability for military misconduct. Although the government has made some progress in responding to public demands by removing soldiers’ immunity and promising that troops involved in human rights abuses will face prosecution, tensions between Darfuri communities and existing security apparatuses are likely to persist. Consequently, the risk of further small and large-scale intercommunal clashes remains high.

Markets likely to open to foreign, private investment, though military elites to remain heavily involved

- As part of security sector reforms, the transitional government pledged to ease the military’s traditional control over state resources, including gold, food staple production, rubber, weaponry, and other resources. For decades, the security sector has controlled the majority of the economy, most notably with a monopoly over the gold mining industry. The military has also been exempt from paying taxes or being transparent about the earnings of industries under its control, all of which left the government with a small budget and lack of hard currency. Until January 2020, the Central Bank was the sole procurer and exporter of gold, which restricted the market and allowed for extensive smuggling and embezzlement of gold resources. This fact that this system benefits the military as well as RSF leader and Sovereign Council Vice President Mohammed Hamdan “Hemetti” has slowed the process of military divestment from the economy during the transitional process.

- PM Abdallah Hamdok and other transitional officials recognize that military divestment from the economy and a restructure of the state budget is critical for economic growth, access to currency, and the opening of Sudanese markets to private and foreign investment. In this context, Hemetti pledged to turn over the Jebel Amer gold mines in North Darfur to the transitional government with mining and production to be regulated and eventually privatized. FORECAST: Other military-owned companies were similarly handed over in recent years, and this is likely to slowly reduce the security apparatus’s control over public sectors and make way for the development of new industries. This includes the development of civil industries, which could become taxable, shareholding companies. However, given that top RSF and military officials remain heavily involved in various industries, including private mining companies, with Hemetti serving on the board of directors of a company tied to Jebel Amer mines, means that these military elites will continue to directly benefit from revenues, including black market revenue streams.

- FORECAST: Although military elites will likely remain involved behind the scenes in private mining company operations and other industries, the fact that the military and RSF have agreed to rescind control in some sectors is likely to bolster the government’s efforts to open the country’s markets to private and foreign investment in the coming months. With a properly regulated gold market, investment opportunities are likely to increase and thereby attract interest for the development of other industries once monopolized by the military. That being said, given that the military has yet to dissociate from the mining sector altogether, and that it continues to benefit financially from its control over many public works programs, water, and fuel distribution, it’s unlikely that the military will allow for the complete liberalization of Sudan’s economy.

Social, security developments underpinned by public economic reforms including subsidy cuts

- The changes to laws on social norms, religious identity, and the security sector would likely not have been possible without the implementation of crucial public economic reforms. Over the past six months, the Sudanese government has enjoyed an increase in political capital and an opportunity to re-engage with the wider international community. The normalization of relations with Israel and removal of Sudan from the US “State Sponsors of Terrorism” list have been crucial steps. The delisting allowed Khartoum to bypass a barrier in accessing funds from international financial institutions, bolstered by US assistance to help the government clear its arrears. However, these warmer relationships have been weighed against Sudan’s pledges to cut subsidies on major commodities such as fuel, wheat, and electricity, which is controversial among a public in which many people rely on the subsidies for basic goods and services.

- Subsidies were said to account for 40 percent of the national budget, which the former Bashir government was unable to borrow money to cover due to sanctions. Instead, the Bashir administration printed money, resulting in rampant inflation. The subsidy system under Bashir kept some commodity prices down for a period, but also led to periodic shortages of key items, as supply chain actors smuggled subsidised goods out of Sudan for sale at higher market prices in neighboring countries. In this context, the transitional government partially cut fuel subsidies in October 2020 in efforts to remedy the situation despite inflation continuing to climb, which was welcomed by the international community as a necessary austerity measure. The government attempted to ameliorate the effects of this by announcing a system of money transfers to people below the poverty line, though 65 percent of the population lives below the poverty line. Nonetheless, there have been recurrent protests since January 2021 in many states over the high costs of fuel, bread, and electricity.

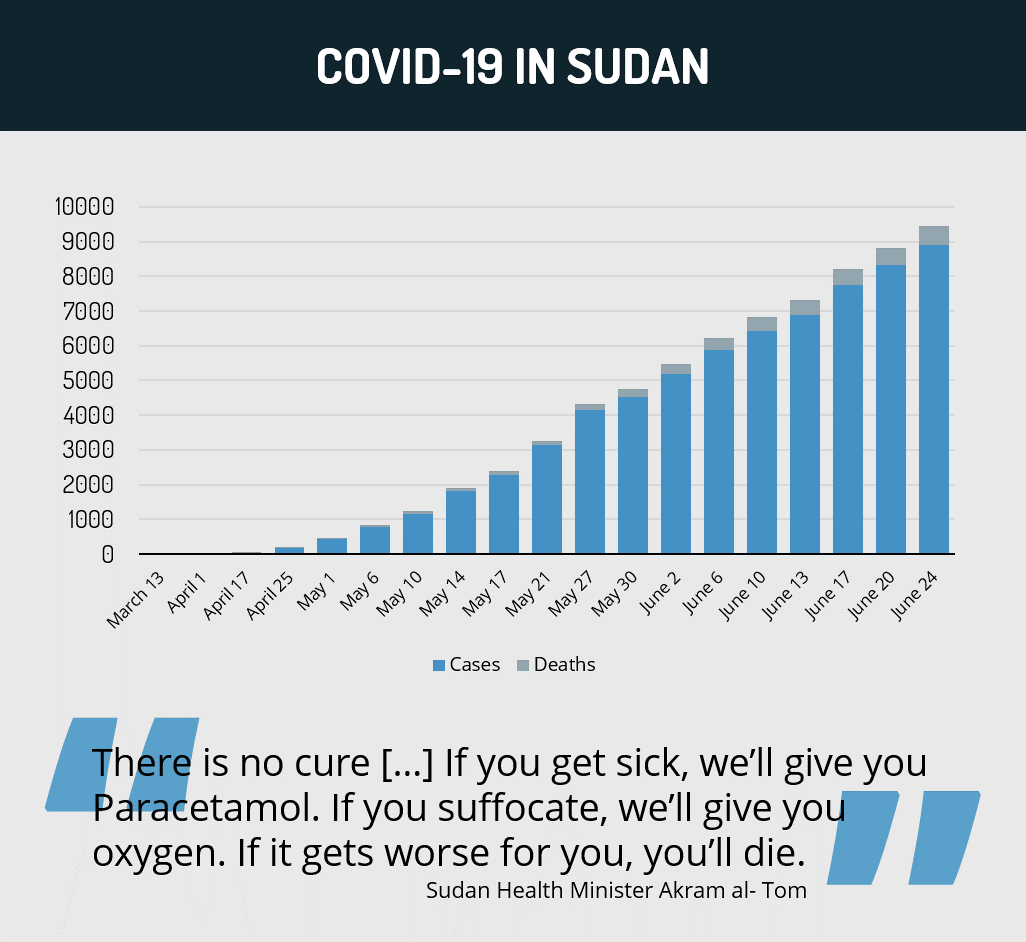

- Given these conditions, despite new economic policies, the government will likely struggle to persuade the public that the reforms will take time to take full effect. This will be further exacerbated by the doubts over the effectiveness of the cash transfer system due to endemic levels of corruption within the government. FORECAST: As the cash transfers are supported by the World Bank and other donors, it is possible that the COVID-19 pandemic could result in a shortfall in international aid as donor countries focus on improving their own economies in a post-pandemic scenario. It remains likely that periodic protests over the economic situation will persist in the coming months. While security forces have been relatively lenient regarding protests held by smaller groups in Khartoum, any attempts to organize a larger-scale protest movement against the government will likely result in a security clampdown.

- FORECAST: Ultimately, the reform process in terms of the removal of subsidies and the devaluation of the Sudanese Pound is likely to have positive effects on economic growth over the coming months. Reforms such as the decision to allow for non-Islamic banking will further encourage foreign investment in the country, with these investors now more able to benefit from projects in Sudan given the opening up of credit avenues and issual of credit cards for the first time. However, the business environment is likely to remain enmeshed in the interests of traditional elites, including the military. While these elites have signaled a willingness to adapt to economic reforms, these power brokers will remain a prominent part of the economy in the coming years.

Recommendations

- Travel to Khartoum can continue while adhering to general security precautions regarding the threat of crime.

- We advise against all travel to the Darfur region as well as South Kordofan and Blue Nile states given the volatile security situation caused by ongoing violence between the government and armed rebel groups as well as intercommunal clashes.

- Maintain vigilance in remote areas of northern and eastern Sudan given the risks of crime and lower presence of security forces.

- Avoid nonessential travel to the borders with Egypt and Libya due to the risk of violent crime, kidnappings, and general lawlessness.

- Avoid the vicinity of all large gatherings or political demonstrations given the associated risk of violent security crackdowns.