Executive Summary

The decline in global oil prices and tourism due to ongoing COVID-19-induced travel and business restrictions has led to severe economic challenges for the Gulf Cooperation Council (GCC) states, which heavily depend on these sectors for revenue. This will likely lead to a recession, as per International Monetary Fund (IMF) projections that the GCC economy will contract by 7.1 percent in 2020.

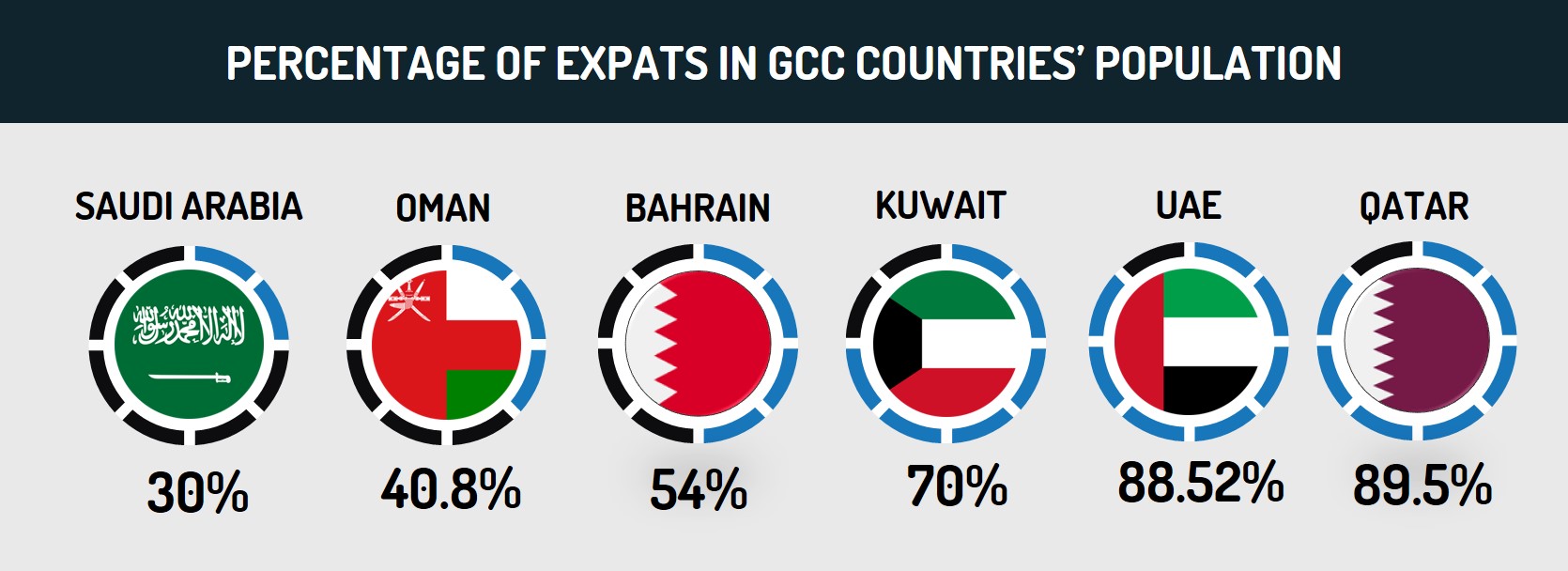

The ongoing repatriation of thousands of expats from the region to their countries of origin as a result of the crisis is likely to have multiple social and economic ramifications, particularly in countries like the UAE and Qatar, where foreign nationals make up almost 90 percent of the total population.

This will lead to labor shortages, increasing the need to expedite the nationalization of the workforce and rapidly train domestic workers, which is unlikely to occur in such a short time span.

Those operating in the GCC states are advised to remain abreast of COVID-19-triggered restrictions and related economic and labor measures that are being undertaken by the respective governments, and to take mitigating actions against potential resultant risks.

Please be advised

In light of the ongoing COVID-19 pandemic, Gulf Cooperation Council (GCC) countries have adopted various measures, the most prominent of which include:

Bahrain

On March 17, the government announced an economic stimulus package worth 11.4 billion USD to support the country’s private sector.

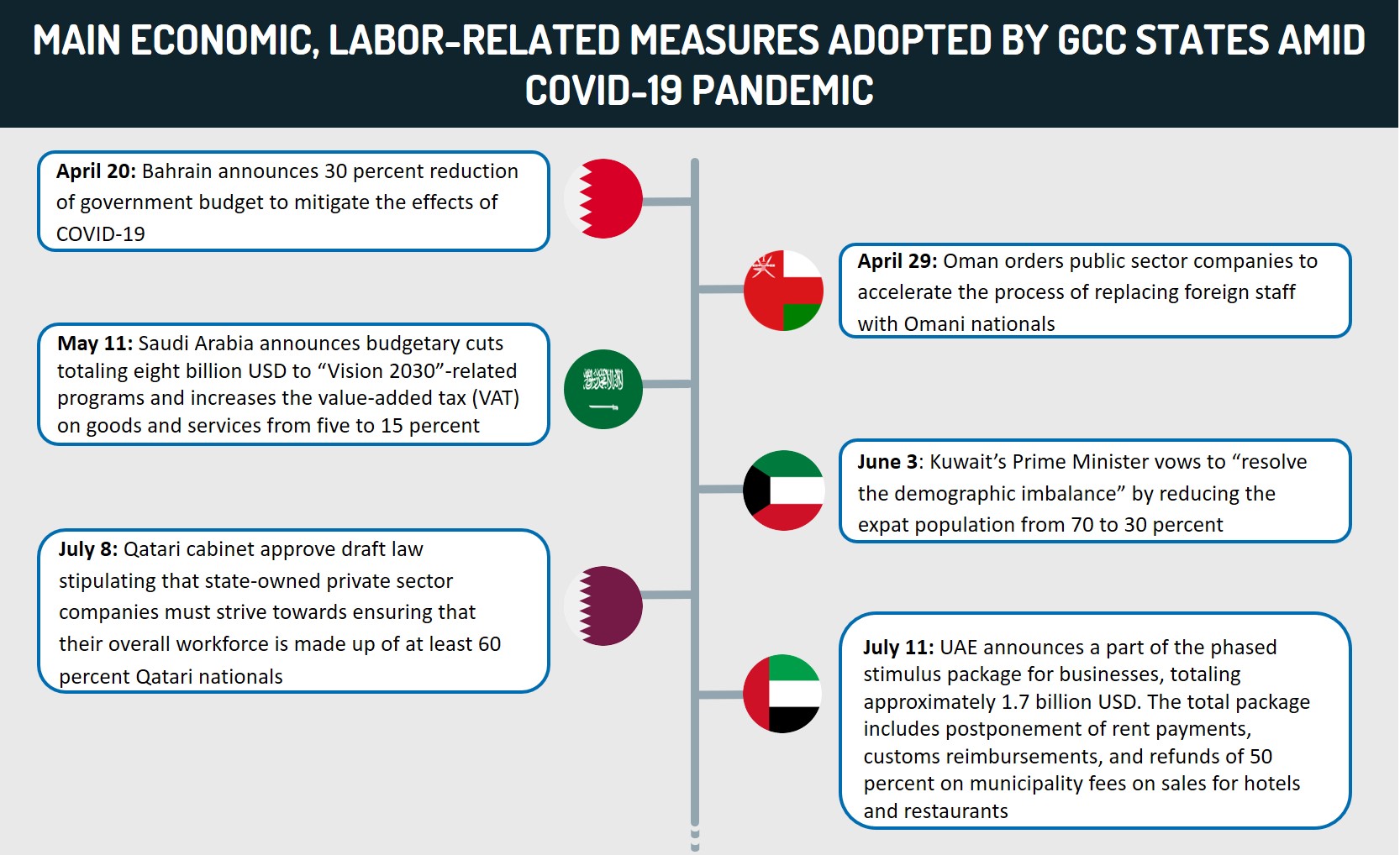

On April 20, Bahrain announced that the budget of ministries and government departments will be reduced by 30 percent, for an unspecified period, in order to mitigate the impact of COVID-19.

According to June 12 reports, the state-owned oil company decided to terminate the contracts of “hundreds of foreign employees”.

On June 15, the government approved a draft law to allocate approximately 470 million USD to the budget of 2020 in order to “deal with emergency expenses required for mitigating COVID-19 impacts and curbing its spread.”

Kuwait

On June 3, Kuwait’s Prime Minister vowed to “resolve the demographic imbalance” by reducing the expat population from 70 to 30 percent.

On June 10, the government announced that expats will no longer be hired in the oil sector.

Oman

On March 17, Oman’s Ministry of Finance announced a five percent reduction in the budget allocated to government agencies.

On April 29, Oman ordered public sector companies to accelerate the process of replacing foreign staff with Omani nationals.

Qatar

According to June 11 reports, Qatar directed ministries and government-funded entities to reduce costs through layoffs or salary cuts of non-Qatari employees.

On July 8, the Qatari cabinet approved a draft law, which stipulates that state-owned private sector companies must strive towards ensuring that their overall workforce is made up of at least 60 percent Qatari nationals.

Saudi Arabia

On April 12, the Organization of Petroleum Exporting Countries (OPEC) Plus, which is de-facto led by Saudi Arabia, agreed to reduce production by 9.7 million barrels per day (mbpd) until July, then by 7.7 mbpd from August-December, and then by 5.5 mbpd until April 2022. The group also called upon “all major producers to contribute to the efforts aimed at stabilizing the market”.

On April 15, the Saudi government allocated 13.3 billion USD to support the private sector.

On May 11, Saudi Arabia announced budgetary cuts totaling eight billion USD to “Vision 2030”-related programs and increased the value-added tax (VAT) on goods and services from five to 15 percent for an unspecified period.

UAE

On July 5, the UAE announced a broad government restructuring for “agile and swift” decision-making amid the pandemic. This includes the merging of energy and infrastructure ministries as well as abolishing several government service centers and converting them to digital platforms within two years.

The UAE has announced a phased stimulus package for businesses, totaling approximately 1.7 billion USD, the most recent part of which was announced on July 11. This has included postponement of rent payments, customs reimbursements, and refunds of 50 percent on municipality fees on sales for hotels and restaurants.

Background

There are several common features that characterize the six GCC economies, namely, Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman. These include high dependency on hydrocarbon revenue, a young and rapidly growing national labor force, and high reliance on the expat workforce. Together, they account for approximately one-fifth of the world’s crude oil production and possess approximately two trillion USD worth of financial wealth.

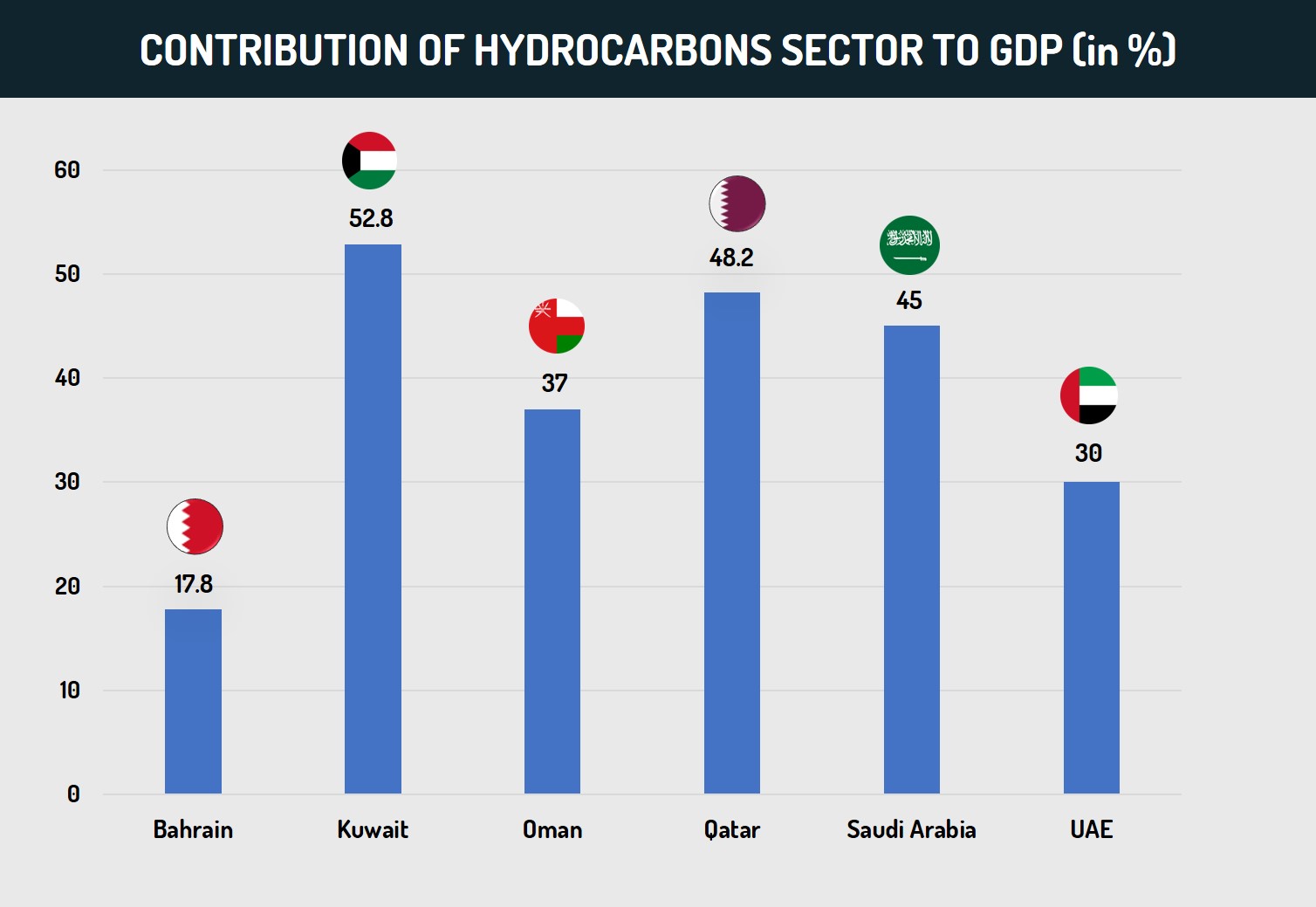

However, there is a wide variation in resource endowments across these states, which, in turn, poses unique risks and challenges for these economies. For instance, Kuwait, Qatar, and the UAE have substantial energy reserves, with relatively small populations, as compared to Saudi Arabia, which has the largest reserves of oil but is spread across a much larger territory and population. Bahrain and Oman, with oil and gas reserves that are relatively limited, are more vulnerable to economic deficiencies when compared to the other GCC states. While plans to diversify their energy-based economies have been in place across the Gulf states in varied scale since the 1970s, the drop in oil prices since 2014 has brought forward the urgency of economic diversification in GCC states.

COVID-19-related restrictions on travel and business operations have had an overall adverse impact on the global economy. The economic ramifications of these restrictions have been severely witnessed in GCC states amid a decrease in the global demand for oil, approximated at 18 percent since the start of 2020. This has led to a steep decline of more than 70 percent in the price of oil, the lowest in over 20 years. According to an IMF report on July 13, oil revenues are now projected to decline by more than 270 billion USD in 2020, relative to 2019.

Assessments & Forecast

COVID-19-related restrictions on business, travel pose significant economic challenges to Gulf countries

Challenges posed by steep decline in oil prices

The hydrocarbon sector, namely oil, petroleum, and gas, as well as their derivatives, contribute significantly to the GDP and government revenue of GCC countries. In the case of states such as Kuwait, Qatar, and Saudi Arabia, the GDP derived from the oil and gas sector accounts for almost 50 percent of their total GDP. At the onset of the global spread of the COVID-19 pandemic, an initial catalyst that contributed to the plummeting of oil prices in the February and March was the failure of Saudi Arabia and Russia, two of the world’s largest major oil producers, to reach a consensus to slash oil production, which led to a price war between the two countries. Thereafter, Riyadh propelled its output to an unprecedented 12 million mbpd in early April in a bid to defend its share in a shrinking market. On April 12, the OPEC Plus reached a deal to slash production by 9.7 mbpd until the end of July, which underscores joint efforts to rebalance the demand and supply in the market. Despite this, oil prices have fluctuated over recent months, largely due to oscillations in global uncertainty amid the spread of the pandemic. FORECAST: While it is likely that the expected easing of restrictions on travel and businesses will boost demand for crude oil over the coming months, the ongoing uncertainty surrounding the pandemic, and potential for additional waves of infection, threatens to derail this recovery.

The decline in oil prices of more than 70 percent over recent months has led to increased financial constraints for all GCC states. This has compelled authorities to slash public spending while simultaneously redirecting funds to help citizens and the private sector cope with the significant financial challenges resulting from the virus. This has been particularly evidenced by reductions in the state budget for 2020 in Bahrain and Oman, as well as the allocation of millions of USD by Saudi Arabia and UAE to boost liquidity in the economy.

FORECAST: Overall, given that government spending is a key driver for economic growth, and is mostly derived from the energy sector, the recent cuts in capital and current spending will likely lead to an economic recession in at least some of the GCC states. This is bolstered by the IMF’s prediction, as of July 13, that the GCC economy is expected to shrink by 7.1 percent this year, both in the oil and non-oil sectors. The fact that this is a revision of the 2.7 percent predicted contraction in April, indicates the overall downward economic trend that is likely to be experienced by all six countries over the coming year, albeit in varying degrees. Most notably, the largest GCC economy, Saudi Arabia, is predicted to shrink by 6.8 percent, per June 24 reports quoting the IMF, compared to a 2.3 percent contraction that was predicted in April.

Meanwhile, GCC countries have long sought to diversify their hydrocarbon export-driven economies in order to decrease the vulnerability of their revenues. To this effect, all of the GCC countries have set out ambitious targets and strategic visions that are also designed to appeal to global investors. These include Bahrain’s Vision 2030, Kuwait’s New Vision 2035, Oman’s Vision 2040, Qatar’s National Vision 2030, Saudi’s Vision 2030, and UAE’s Vision 2021. However, given that commitment to these reforms have been inconsistent over the past years, most governments continue to rely on oil revenues. FORECAST: In this context, the slump in oil prices, as well as the overall depreciation of government revenue over the recent months indicates that investments in non-essential projects, such as in the sectors of infrastructure and real estate, will likely be postponed, which will further prolong the countries’ efforts to diversify their sources of income.

Challenges posed by decline in tourism, hospitality industry

Most GCC states have made significant efforts to transform to a hub for tourism and hospitality over recent years, constituting a major economic driver in terms of these countries’ economic diversification strategies. To this effect, GCC states have laid out long-term plans for airport expansions to increase the handling capacity of projected visitor inflow, further supported by the relaxation of visa rules to further boost tourist arrivals. Moreover, the hosting of mega-events, such as the Expo 2020 in Dubai and the FIFA World Cup 2022 in Qatar, were expected to grow the GCC’s leisure and hospitality construction sector expenditure from 467 billion USD in 2019 to 642.3 billion in 2023, implying a five-year compound annual growth of 8.6 percent, compared to the 5.7 percent achieved in 2013-18.

FORECAST: In this context, the effect of COVID-19-induced restrictions on travel between countries will have a significant economic impact on the GCC countries. For example, according to reports, the forecasted revenue loss for the UAE airline industry alone is projected at 5.3 billion USD, due to the drop in approximately 23.8 million passengers. Additionally, the postponement of highly anticipated events will exacerbate these losses. For instance, the Expo 2020 in Dubai, which was originally scheduled to take place in October 2020-April 2021 and was expected to contribute approximately 30 billion USD to the economy, will add to the decline in predicted revenues. Saudi Arabia will likely face similar challenges, given that authorities have banned pilgrims from other countries from traveling for the Hajj pilgrimage, which is slated to begin on July 28. This is particularly given that Hajj, which witnesses the arrival of almost 2.5 million pilgrims every year, generates an annual revenue of approximately 12 billion USD.

Measures adopted to mitigate economic challenges likely to increase socio-economic grievances, labor shortages

The “rentier state” model in the Gulf region has been long associated with the overall lack of taxation due to the abundance of allocated resources, wherein the state offers its citizens goods and services in return for substantial autonomy in decision-making, which is often characterized by a reduction in political engagement. However, economic conditions that have persisted across recent years, particularly in the wake of declining oil prices since 2014 and increased budget deficits in 2015-16, indicate that this pattern of governance is no longer feasible, especially as prolonged low oil prices could worsen the fiscal situation. Along with increased borrowing through the issuing of local and international bonds, in 2016, all GCC states signed an unprecedented framework for the introduction of Value Added Tax (VAT), known as the Common VAT Agreement. While the measure came into effect in the UAE and Saudi Arabia on January 1, 2018, and in Bahrain on January 1, 2019, other countries have stated that they needed more time to implement the reform. In the former states, a five percent levy has been imposed on several designated essential products and services including gasoline and diesel, food, clothes, utility bills, and hotel rooms, with the exception of public transport, medical treatment, and financial services. Similarly, a 50-100 percent “sin tax” has been imposed on certain products, including soft drinks and tobacco, in the UAE, Saudi Arabia, and Oman. In this context, Saudi Arabia’s tripling of VAT from five to 15 percent on May 11 highlights the Kingdom’s efforts to accelerate revenue generation through the collection of taxes.

FORECAST: These measures, combined with the cutting of the cost of living allowance for state workers that has been in place since 2018, will likely increase socio-economic grievances among the local population due to the increase in the cost of living. While Riyadh’s move was expected to cause a ripple effect across the region, the UAE’s Ministry of Finance indicated on May 12 that the country did not have immediate plans to raise taxes. Oman and Kuwait are expected to introduce VAT systems by 2021. However, given the possibility of protracted economic effects of COVID-19, there remains a potential for the introduction of tax reforms and other austerity measures by the remaining GCC states over the coming months.

Furthermore, the COVID-19 pandemic has forced many sectors across the GCC to shore up spending through layoffs and employee salary cuts. In this context, given that a high percentage of the population of most GCC states’ workforce consists of expats, it is this community that is liable to be most impacted by the economic downturn. While several governments have implemented policies that seek to prioritize employment for local citizens at the expense of foreign workers over the recent years, since the outbreak of the health pandemic, an acceleration of these measures has been witnessed in countries such as Oman, Qatar, Bahrain, and Kuwait.

This is evident by Oman’s April 29 decision to replace expats with Omani nationals in its public sector, as well as Qatar’s June 11 directive to all state-owned entities to curb spending through layoffs and salary cuts of expats, rather than Qataris. Meanwhile, Kuwait has explicitly stated its objective to reduce the expat population from the current 70 percent to 30 percent, although no timeframe was attached to this objective. This is part of an effort to address the demographic imbalance in the country, as indicated by the Kuwaiti PM’s statement on June 3. Kuwait has further passed measures such as a ban on the hiring of expats in the country’s oil and municipality sectors. Furthermore, several lawmakers have also tabled a bill in the parliament to introduce a quota system, wherein the percentage of expat population from different countries will be capped at certain ceilings.

To some extent, the sense of urgency in passing such expat-focused legislation has also been triggered by the growing perception that the spread of the virus in some of the GCC countries has been caused by foreigners, particularly by blue-collar workers that make up a high percentage of the countries’ migrant population. This is primarily due to the fact that a majority of such workers live in low-cost, overcrowded labor camps, a number of which had emerged as hotspots for the spread of the virus, as in the case of Doha’s Industrial Area. This may have increased resentment among parts of the local citizenry towards the migrant population, due to the pressure placed on the country’s resources and infrastructure amid the current health crisis.

That said, such policies and sentiments vis-a-vis the expat population do not resonate uniformly across all GCC states. For instance, per June 11 reports, UAE’s Minister for Infrastructure Development stated that the “UAE is a place where expats are well-skilled and we definitely need them. The pandemic is not going to be here for a long time…then we would regret that we got rid of our skilled workforce, whether it is nationals or expats. We would like to keep them”. This indicates the country’s recognition that the expat population, especially skilled migrants that constitute a majority of the middle class in the UAE, are vital for economic growth and development. This is further evidenced by the fact that the UAE and Saudi Arabia have not passed any major legislation over the recent months that seeks to specifically slash the expat population by denying them employment. FORECAST: Regardless of the absence of long-term policies to “address the demographic imbalance”, as in the case of Kuwait, the large departure of the migrant population, some of whom who are being repatriated to their home countries from the Gulf amid the COVID-19 pandemic, is liable to have several far-reaching social consequences. This will be explored in the next section.

Social, economic implications of economic slump, expat-focused measures over coming months

Domestic impact on economy, potential for labor shortage

FORECAST: The sudden exit of the migrant worker population will significantly alter the demographics, especially in countries like the UAE and Qatar, where foreign residents comprise approximately 90 percent of the population. In the UAE alone, more than 350,000 Indian nationals, and over 60,000 Pakistani nationals, have registered to be repatriated, as of the time of writing. Similarly, over 25,000 Indians have reportedly registered for repatriation due to job losses in Saudi, while 10,000 such nationals have already departed from Qatar. Moreover, countries like Kuwait also announced amnesty schemes for the evacuation of workers of all nationalities, which has reportedly benefitted over 45,000 Indians and other nationals. This will therefore have substantial economic and social implications over the coming months and years, which is expected to be larger than those witnessed during the 2008-2009 financial crisis.

FORECAST: The uprooting of middle-class residents and their families is liable to negatively impact the domestic economy, as sectors that relied on these customers such as restaurants, schools, clinics, and the retail sector, will suffer major losses. Without government support, these services will be forced to lay off more people, which may trigger a deflationary impact and likely lead to a secondary wave of migrant exodus. The exit of low-income earners, such as domestic assistance, will also lead to social implications, as this may force a change in the overall lifestyles of locals. In the UAE, it is suggested that 96 percent of Emirati families employ domestic help to raise their children, highlighting the dependence of the local population on expat workers.

FORECAST: The utility of expats as consumers and sources of revenue in the form of taxes and fees, including VAT on goods and services, road tolls, and visa renewal fees will decrease. For example, in 2018, the UAE collected approximately seven billion USD in VAT collection, which accounted for almost 1.7 percent of the country’s nominal GDP that year. Similarly, Saudi Arabia collected almost 9.3 billion USD in the form of VAT in 2018. Saudi was also expected to raise 17.3 billion USD in 2020 in the form of expat visa renewal fees, as well as the charges that are to be paid by companies for every foreign worker they hire. Therefore, this will contribute to a further reduction in government revenue.

FORECAST: A labor shortage will likely be experienced in the market over the coming months due to the departure of expat personnel, both high-earning professionals and low-income workers. This will likely be most acutely felt when the economy and oil prices rebound and stabilize to a relative degree, which will, in turn, facilitate the resumption of several infrastructural and development projects that have been currently postponed. The implementation of these projects will be hindered by the labor shortage. This is given that ambitious development plans adopted by the GCC states have largely led to an extensive, unregulated import of both skilled and unskilled labor. Moreover, the financial ability of these countries to purchase technology and knowledge also meant that professional development has not always been a top priority. This has led to a disconnect between rewards offered to nationals in the form of lucrative jobs in the public sector, unemployment and other benefits, and their level of merit and competency.

FORECAST: Therefore, GCC governments will likely face significant challenges in developing the skill sets of its national workforce to fill the gaps within the labor market over the short term. Authorities will be forced to provide substantial incentives for citizens in order to attract them towards the private sector at a time of diminishing resources, as employment in the public sector for most countries has either been or are approaching saturation. In the absence of such incentives, there also remains a possibility for protests in demand of better employment and economic opportunities. However, in many states, the overall lack of large civil society organizations and protest groups as well as a broader absence of a protest culture will render it difficult for a potential anti-government movement to mobilize.

FORECAST: Overall, COVID-19-triggered restrictions and resulting losses in revenue in both the private and public sectors have, and will likely continue to lead to, job layoffs and salary cuts across the region. For short-term delay, most GCC governments have announced emergency economic stimulus packages. These have included the expansion of government loans provided to businesses, direct cash transfers as partial payment of salaries, as well as deferments on rent and utility payments to help citizens and residents cope with the economic impact of the pandemic. Additionally, governments have been forced to utilize resources on protective measures and health infrastructure to mitigate the spread of the pandemic, bolstered by the free testing and treatment of the virus in several countries, including the UAE and Saudi Arabia. These costs are liable to increase in the event of further waves of infection. However, over the coming years, restrictions will gradually be eased in order to restore economic activity. Given the already diminished government revenue as well as the pressure to curb state expenditure and bolster public finances, states will be compelled to mitigate economic challenges by increasing taxes and training the local workforce. However, as noted, this will have a profound impact on the economic structure, social dynamics, and functionality of these societies.

Recommendations

Travel and operations can continue in GCC states while remaining abreast of COVID-19-related restrictions and procedures, as well as of social and economic developments due to changes to the workforce and reductions in state revenue.

It is therefore advised to take necessary measures to mitigate the potential adverse effect of these developments to ensure business continuity, while allotting for potential disruptions and service failures in these countries.

Furthermore, it is advised to maintain vigilance due to the heightened risk of anti-foreign sentiment in the GCC states on account of the perception among some parts of the local populace that expats are a burden on their resources.