Current Situation

Click here to see Map Legend

Click here to see Map Legend

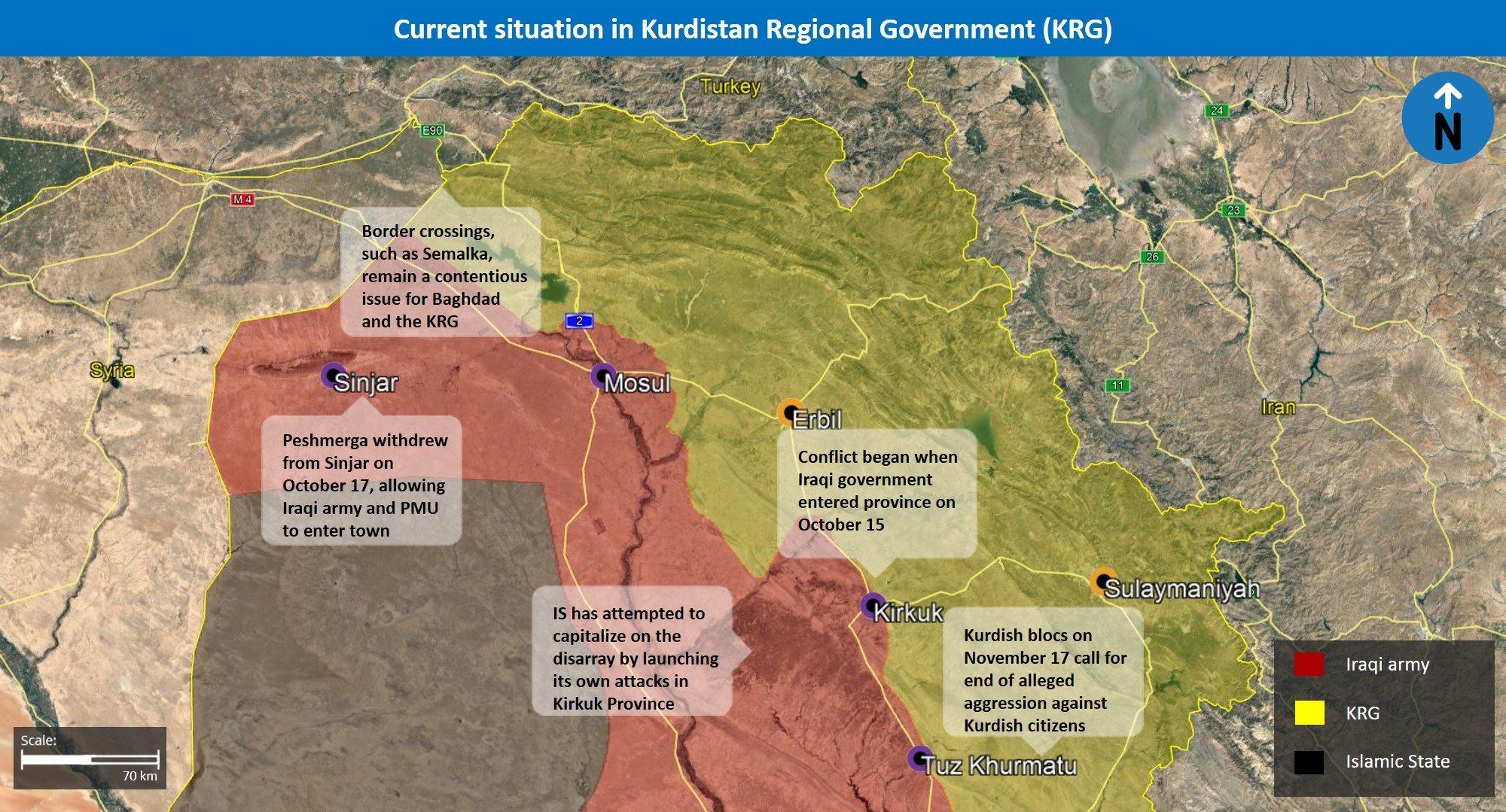

Following the Kurdistan Regional Government’s (KRG) passing of an independence referendum on September 25, the Iraqi army, along with Iranian-backed Shiite Popular Mobilization Units (PMUs), entered and took control of Kirkuk Province. Since then, hostilities between pro-Iraqi government forces and Kurdish Peshmerga forces have halted as both sides engage in negotiations. The president of the KRG, Masoud Barzani, resigned on October 29, calling into question the future of northern Iraq. Islamic State (IS) has already taken advantage of the disarray to launch its own attacks in attempts to make a comeback as it faces major setbacks elsewhere.

Negotiations between KRG and Baghdad

Negotiations between the Iraqi central government and the KRG remain at a stalemate and were partially stalled following the 7.3 magnitude earthquake taking place along the Iraqi-Iranian border.

Control of border posts is the most recent contentious issue between the two parties. The KRG offered a proposal to share control of the 29 border crossings currently under Kurdish Peshmerga administration; however, the Iraqi government rejected this offer and demanded they be handed over. Iraqi officials threatened military action if border posts remain in KRG-control, but no such actions by the army have taken.

Oil is also a heavily debated issue between the two sides, especially as the KRG economy is heavily reliant on oil revenues. Kirkuk Province previously served as the main supply for oil for the KRG prior to the Iraqi government’s seizure. Officials in the KRG stated that Baghdad was no longer sending oil like it did in the past, to which the Iraqi government responded by guaranteeing fuel deliveries in the coming weeks.

The Iraqi government continues to take punitive measures against the KRG as negotiations remain ongoing. The Central Bank’s decision to call on all banks to “halt operations” in the KRG “indefinitely” and the banning of international flights to and from northern Iraq are examples and both policies remain in place.

In terms of hostilities, fighting between both sides decreased significantly in recent weeks.

Politics in the KRG

Tensions remain between the ruling Kurdistan Democratic Party (KDP) and the opposing Patriotic Union of Kurdistan (PUK), as the former holds a grudge for the latter’s decision to coordinate with the Iraqi central government and allow troops into Kirkuk at the start of the offensive.

Political tensions led to the resignation of former KRG President Masoud Barzani, whose roles were absorbed by his grandson Prime Minister Nechirvan Barzani. For the most part, the prime minister continued expressing the views of his grandfather, stating that the Iraqi government was “violating the constitution” by initiating talks with individual provinces in the KRG, instead of with the Kurdish government as a whole.

Iranian involvement

Following Iranian-backed Shiite Popular Mobilization Units (PMUs) heavy support for the Iraqi government in the taking of KRG territory, Tehran stayed involved in the negotiation process and in Iraqi internal affairs.

On November 11, Baghdad and Tehran agreed to export oil from Kirkuk Province to Iran. According to the deal, over 30,000 barrels of oil a day would be exported to western Iran and in exchange, Iranian oil will be sent to southern Iraq.

Additionally, Iraq’s electoral commission authorized two more PMU groups’ political wings to run in upcoming elections in 2018, despite a law prohibiting individuals associated with the PMU from running for political office. The Iranian-backed Kataib al-Tayyar al-Risali and Asaib Ahl al-Haq groups’ political wings were both approved by the electoral commission.

US position

Since the start of the conflict, the US government avoided taking sides and attempted to remain neutral. US officials provided no armed or financial support to either side during the hostilities and pushed for negotiations between the two parties.

Prime Minister Barzani, however, claimed that the US is not playing a neutral role and accused the US of taking Baghdad’s side in the conflict.

Islamic State (IS)

Twin suicide bombings targeted PMU offices in Kirkuk City on November 5, leading to multiple casualties. No group claimed responsibility, yet IS has already taken advantage of prior hostilities to make its own gains of small villages near Kirkuk. As hostilities between the Iraqi army and the Peshmerga have ceased, IS activity has been reduced.

Also, on November 16, IS-linked news agency reported the killing of five Iraqi troops in clashes near Kirkuk Province’s village of al-Riyadh, located about 45 southwest of Kirkuk City.

Assessments & Forecast

The Iraqi government and the KRG both have different core objectives in ongoing negotiations, which has likely led to the current stalemate. Baghdad seeks government control over the entire KRG region, including the armed Peshmerga, which Iraqi Prime Minister Haider al-Abadi said should immediately come under Iraqi command. To achieve this outcome, the Iraqi central government began implementing a “divide and conquer” strategy, namely by promoting divisions within the KRG. The Iraqi government already began holding separate meetings with individual local provincial councils and relying heavily on the opposition PUK. The KRG, however, seeks internal unity so it can negotiate with Iraqi authorities on equal ground. Prime Minister Barzani has led the charge on bringing all factions within the KRG together, as well as calling on Baghdad to honor the Iraqi constitution, which gives regional autonomy to the Kurds in northern Iraq.

A stalemate has ensued between the Iraqi government and the KRG as the parties have failed in settling multiple disputes, including control of the latter’s border posts. International actors now have a chance at shifting the direction of these talks in shaping the future of the KRG. Iran has taken initiative in this respect by pressuring the Iraqi government to stay forceful, as Tehran already did when encouraging Baghdad to seize control of Kirkuk. Iran benefits greatly from the ongoing conflict as the Iraqi government was forced to rely on the Iranian-backed elements of the PMU in order to proceed forward with gains in the KRG. A stronger PMU allows Iran to have greater influence in Iraq and thus, permits Tehran to further influence the future of the KRG. A weak KRG not only supports Tehran’s objectives in Iraq, but also serves as a major blow to Kurdish factions fighting in Iran, as the Peshmerga had been a prime example for Kurdish autonomy in the region. Additionally, a weaker Peshmerga would damage Kurdish militants’ capabilities in Iran itself as such elements are known to train in Iraq. Tehran would also be able to make it harder for these Kurdish-Iranian militants to travel back and forth between the countries.

The US is one party that could ultimately counter such Iranian influence in Iraq. While the US has attempted to stay neutral, it has released statements over the past week demonstrating opposition to the Iraqi army’s military operations in areas other than Kirkuk Province. As hostilities have stalled, however, the US refrained from backing any of the parties and has sent delegates to the region to encourage negotiations. Overall, the US has offered weak responses to Iran’s rising influence in the country, namely through their PMU proxies. Secretary of State Rex Tillerson’s call for Iranian-backed militias to “go home” stands as the only stated opposition to actions supported by the Iraqi government to date. Additionally, US President Donald Trump’s “America First” platform is only likely to further discourage any serious action by the US, despite Trump’s persistent opposition to Iranian actions taken in the Middle East.

Saudi Arabia also has the potential to impact the Iraqi government and sway it away from Iran. The Saudi government made such attempts in October by signing agreements with Iraq which involved multiple political and economic deals including the relaunching of certain flights between the countries and working together to develop new ports and highways. While this approach may strengthen the Iraqi-Saudi alliance, the Saudis are still being cautious, which contrasts greatly from Iran’s more aggressive actions. Iranian-backed Shiite militias would also view such relations between Iraq and Saudi Arabia as negative, thus potentially damaging Baghdad’s control of these units and causing further tensions in Iraq between Sunni and Shiite communities.

Without any party willing or fully able to counter Iran’s heavy influence in the country, the Iraqi central government is likely to stay aggressive in its demands going forward, including continuing to call for full control of all border crossings and potentially other disputed territories currently held by the KRG. The Iraqi government’s divide and conquer strategy will likely succeed over Prime Minister Barzani’s attempts to unite the KRG given these already existing internal divisions. Additionally, Barzani’s deep connections to the former president make him unlikely to be the figure that all elements in the KRG will stand behind. Instead, regional governments will likely seek a new KRG leader to support, potentially turning to the PUK, which could thus strengthen the Iraqi government’s hand in negotiations once again.

If negotiations remain at a stalemate and Baghdad is unable to convince the KRG to hand over border crossings and other disputed territories, the PMU may lead the charge in aggressively seizing these areas, even if it goes against the Iraqi government’s wishes. Shiite militiamen have been successful in controlling and administering their own territories close to the KRG border, including in Salahuddin Province’s Tuz Khurmatu, where unconfirmed reports have recently indicated that the PMU has strengthen their numbers. Iraqi authorities’ reluctance to proceed with more force may be countered with Iranian pressure to seek military solutions to the current disputes. Spokesmen of these militias have stated in the past their willingness to turn on the Iraqi government if Iran demanded it, thus underscoring the danger that such militias could ultimately present.

The PMU’s taking of such actions could also provide a larger opening for IS to take advantage of the disarray, as already witnessed in recent weeks. The jihadist group lost its last urban stronghold in Anbar Province on November 17, largely forcing them to retreat to the desert with no territory left to hold. Such developments have pushed the jihadist militants to be more active on other fronts where sleeper cells and sympathizers for the group exist. This includes Kirkuk Province where IS militants have staged multiple attacks since the outbreak of this conflict. While the jihadist group has not been able to consolidate any territorial gains, if the PMU stages offensives on Peshmerga-held areas, IS could change its situation very quickly and move in amidst the disarray to take small villages that it previously held. Additional IS attacks in Kirkuk Province remain likely to occur in the short term.

Recommendations

It is advised to defer all travel to Baghdad at this time due to the daily threat of militancy in the capital, violence in areas surrounding the city, and the risk of a broad deterioration of security conditions.

For those remaining in Baghdad, it is advised to ensure that contingency and emergency evacuation plans are updated. Contact us for itinerary and contingency support options.

We advise against nonessential travel to Basra. If travel is essential, contact us for itinerary-based consultation and on-ground support.

Travel to areas outside of Baghdad and Basra should be avoided at this time, particularly to the north and west of the country, including the Anbar, Nineveh, Salahuddin, Kirkuk, and Diyala Provinces due to ongoing combat operations. This is in addition to avoiding the Babil Province, south of Baghdad. Those operating in these regions are advised to contact us for itinerary and contingency support measures, including evacuation options, given the deterioration in the security situation. Consult with us before traveling to Kirkuk City.

Travel to Erbil and Sulaymaniyah may continue at this time while maintaining heightened vigilance and adhering to standard security precautions regarding the threat of militant attacks. Avoid all nonessential travel in the Kurdistan Regional Government outside of Sulaymaniyah and Erbil.